What Is Cash Outlay?

Content

Negative cash flow, in contrast, means that you’re spending more money than you’re taking in. What you really want is deep insight into the breakdown of cash inflows and outflows so you can continuously improve efficiency and map out more strategic growth plans. Improving cash flow can mean increasing positive cash flow or changing negative cash flow into positive. Cash inflow is the money going into a business which could be from sales, investments, or financing.

An outlay cost is a cost incurred in order to execute a strategy or acquire an asset. Outlay costs are also paid to vendors to acquire goods such as inventory or services, such as consulting or software design. They are concrete expenses that are actually incurred in order to achieve a goal. A lumpsum investment may also be part of the initial cost when an asset is purchased for expanding the revenues. Therefore, the initial investment is equal to gross investment plus an increase in net working capital. In addition to changing your terms, look at your billing procedures and see if there are any payment obstacles you can remove on your end.

In the financing category, cash inflow includes the amount of money that you borrow and income generated by selling stock or equity. Cash outflows refer to dividend payments and the funds used for principal repayment the principal amount on existing debt. To build a business that can profit in the long term, you need to know that your inflows will ultimately exceed outflow. When you have more cash entering your business than leaving it, this is known as positive cash flow.

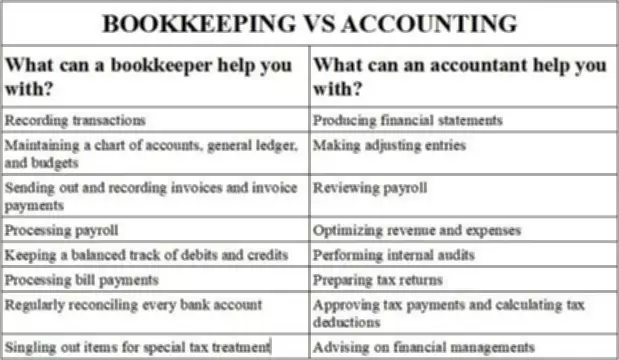

Financial Accounting and Reporting

He has authored articles since 2000, covering topics such as politics, technology and business. According to CB Insights, 15% of startups fail because of pricing or cost issues. This might not seem like a lot until you realize that poor pricing kills more startups than bad teams, wrong timing, and inferior products. Plus, when you’re known as a customer who always pays on time, you have the leverage to renegotiate better terms with your suppliers.

Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

Short-term cash flow reports let you see how you manage your limited runway in real-time. With Mosaic, you can access this information easily on your financial dashboard. Cash flow forecasting uses your existing cash flow to help you predict future bank balances.

Tailor Your Cash Flow Forecasts

The most basic form of cash flow reporting is the standard cash flow statement (or statement of cash flows). Long-term costs may be lower when purchasing property and equipment, but the initial outlay is larger. Assessing the amounts, timing, and uncertainty of cash flows is one of the most critical objectives of financial reporting. It is important to understand a company’s liquidity, ability to fund operations, and overall financial performance and health.

- This is crucial for mature VC-backed startups and public companies that have to show they can run efficiently while still growing.

- Simply put, it’s the difference between what a company spends and what it earns.

- On the other hand, cash inflows are the opposite as they occur when money flows into the company, which can be a result of daily sales, positive investments, and profitable financial activities.

- The after-tax cash flows are often termed Net Cash Flows (NCF) which is nothing else but the difference between cash receipts and cash payments including the taxes.

Accountants record cash outflows in a statement of cash flows, also referred to as a liquidity report or cash-flow statement. As corporate expenses, cash outlays are integral to a statement of income, also known as a statement of profit and loss. A cash flow statement is divided into three sections, one for each activity type. You record cash inflows as positive amounts (credits) and cash outflows as negative values (debits) in each section. Then, you have your net cash flow for each activity and your business as a whole.

Tips for Improving Your Business Cash Flow

Modern CEOs and finance departments should consider cash flow, as well as bottom-line savings when determining their budgets. Paying on time to your suppliers will help you negotiate better terms with them and benefit from early payment rewards from your financial institution. Remove any possible future payment obstacles and ensure you send invoices promptly so your customers have enough time to review and pay.

The saved cash flow for taxes is an inflow of cash, and the savings resulting from depreciation is known as the depreciation tax shield of the investment project. Cash flow management is the practice of conducting regular cash flow analyses to stay on top of your business’ cash position. It allows business owners and finance leaders to make important business decisions based on their company’s financial health. General and administrative expenses also form part of cash outlays, as do salaries, utilities, and insurance. Outlay costs, sometimes referred to as explicit costs, are direct expenses paid.

Cash touches every aspect of your business, so it makes sense that several factors can affect your cash flow. The current dollar amount of open bills, based on days since the bill date. For more information on financial intelligence dashboards that cut down data aggregation times and deliver powerful insights faster, get a personalized demo of Mosaic. Running a business without checking your financials is like a doctor trying to select a treatment without taking their patient’s vitals. This might mean increasing prices or charging for features and services you’ve been providing for free.

Incentivize Early and On-Time Payments

Then there are the implied costs of choosing one widget press over another. In addition, the other opportunity costs include choosing the widget press over another type of equipment or method. It does not have any direct effect on cash flow but indirectly affects the cash flow through the tax liability of the firm. Taxes are computed on accounting profit which treats depreciation as deductible expenses. Alternatively, you can use financial analytics software to visualize your cash inflow and outflow over time.

Simply put, it’s the difference between what a company spends and what it earns. For example, the outlay on a new air conditioner would include its buying price, taxes, delivery charges, plus any set up and installation costs. It is the total cost of achieving an objective, acquiring something, or carrying out a decision.

Money-seeking firms also may reach out to external financiers, such as stockholders and lenders. Sometimes you’ve done everything you can to reduce expenses, but you can’t achieve positive cash flow, or you don’t have enough on hand to invest in growth. Leverage credit and debit payments for your expenses to improve your overall financial efficiency. As an added benefit, you may be able to take advantage of early payment discounts, reduce late fees, and even earn cashback rewards from your credit card provider. CEOs and CFOs should take an active role in watching over cash flow trends so they can improve money management and optimize their limited resources. This way, cash flow becomes a forward-looking strategic tool, not just another element of financial analysis after the fact.

As a rule of thumb, net cash inflows should always be calculated on an after-tax basis. Examples of cash inflow include money earned from selling products and returns on any investments. Conversely, cash outflow can consist of your operating expenses, debts, and other liabilities. When you lease, you get the same equipment for a smaller initial cost, and you can negotiate terms to lower your monthly expenditures. Doing so reduces your cash outflow and leaves more money in your business to use for operating expenses.

Cash Outlay definition

Specifically, ensure that you’re sending invoices out promptly and giving your customers enough time to review and pay. Buying property and equipment may be cheaper in the long run, but it requires more capital upfront. Even if you finance your purchase, many banks and lenders require down payments of 20% to 30%. Inflow from operating activities includes the net income you generate from the sale of goods/products and services, inventory, and accounts receivable.