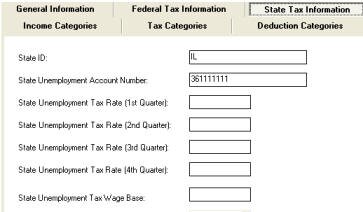

What Is My State Unemployment Tax Rate?

Content

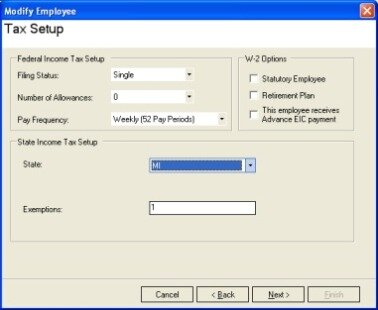

Employers are allowed to deduct a small percentage of an employee’s pay (around 4%). Another tax, social insurance, is withheld by the employer. Calculate state income taxes using a worker’s gross wages, filing status (single, married filing jointly, etc.), and withholding preferences. Each state that has a state income tax provides tax rates to determine the tax liability. After collecting federal withholding tax from employees, an employer can pay them online using the Electronic Federal Tax Payment System .

State payroll taxes include income tax, unemployment tax, and possibly local taxes. Workers pay state income taxes, and employers typically pay state unemployment taxes.

Texas State Income Tax

Unemployment Insurance is funded jointly through both federal and state payroll taxes. State unemployment insurance rates vary from employer to employer. Keep in mind that your state labor department should mail your business’s specific rate to you each year. In Bermuda, payroll tax accounts for over a third of the annual national budget, making it the primary source of government revenue. The tax is paid by employers based on the total remuneration paid to all employees, at a standard rate of 14% (though, under certain circumstances, can be as low as 4.75%).

Generally, your SUTA tax rate is based on the amount of unemployment claims that are filed by employees that you have terminated. When your business is new, your SUTA tax rate starts at the maximum and declines if you build a history of few claims. Employers are subject to unemployment taxes by the federal and all state governments.

These taxes come from the wages, salaries, and tips that are paid to employees, and the government uses them to finance Social Security and Medicare. Employers withhold payroll tax on behalf of their employees and pay it directly to the government. If you take a close look at your earnings statement, you’ll see that payroll taxes take a serious bite out your paycheck. But afinancial advisor can look into your payroll taxes and help you reach your financial goals. Paying your payroll taxes correctly and on time is an important part of being successful as an employer, but it can become challenging as you grow. Tax rates change from year to year, especially state payroll tax rates, and you must keep track of them to calculate your business and your employees’ tax obligations accurately.

The second kind is a tax that is paid from the employer’s own funds and that is directly related to employing a worker. These can consist of fixed charges or be proportionally linked to an employee’s pay. The charges paid by the employer usually cover the employer’s funding of the social security system, Medicare, and other insurance programs. Under the umbrella term “payroll taxes,” employers are required to withhold state and federal income taxes from their employees’ earnings, as well as Social Security and Medicare taxes.

As an employer, you must also pay a matching amount of FICA taxes for your employees. You are required to withhold 6.2% of an employee’s wages for social security taxes and to pay a matching amount in social security taxes until the employee reaches the wage base for the year. The wage base for social security tax is $97,500 for the year 2007. Once that amount is earned, neither the employee or the employer owes any social security tax. The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, , Employer’s Tax Guide for more information; or Publication 51, , Agricultural Employer’s Tax Guide for agricultural employers.

Tennessee Unemployment Insurance

Below is a state-by-state map showing tax rates, including supplemental taxes and workers’ compensation. On this page you’ll find a comprehensive guide to federal income tax, federal payroll tax, and the federal withholding form. You can also select a state to see state tax rates, state withholding forms, and state paycheck calculators.

Tax rates differ by state, and some states don’t charge a state income tax. In other words, when employees contribute to their HSA through a payroll deduction, the money is excluded from federal income taxes and FICA/FUTA taxes.

The other type of Swedish payroll tax is the income tax withheld , which consists of municipal, county, and, for higher income brackets, state tax. In most municipalities, the income tax comes to approximately 32 percent, with the two higher income brackets also paying a state tax of 20 or 25 percent respectively. The combination of the two types is a total marginal tax effect of 52 to 60 percent. Social security and Medicare taxes, also known as FICA taxes must be withheld from your employees’ wages.

Because it’s a business expense it can be written off at tax time. The federal payroll tax rate is 6.0 percent on the first $7,000 of covered wages, but tax credits reduce the effective federal tax rate to 0.6 percent . State unemployment tax rates and wage bases vary but are usually below 4.0 percent and are on low wage bases. California PIT is withheld from employees’ pay based on the Employee’s Withholding Allowance Certificate (Form W-4 or DE 4) on file with their employer. The withholding rate is based on the employee’s Form W-4 or DE 4. Using a payroll provider like QuickBooks Payroll will help ensure you are always up-to-date on federal and state payroll tax rates.

Refer to Notice PDF and Notice PDF for information allowing employers to defer withholding and payment of the employee’s share of Social Security taxes of certain employees. Employers are also responsible for paying state and local (city, county, etc.) payroll tax on behalf of employees. As with federal payroll tax, part of this tax is employer paid and part is employee paid. Keep in mind that “employee paid” just means that you, the employer, withhold a certain amount from your employee’s paycheck and then remit it as part of your payroll taxes. The federal government levies payroll taxes on wages and uses most of the revenue to fund Social Security, Medicare, and other social insurance benefits. Federal income taxes also go towards things like defense and security.

You won’t technically even have to remember the tax rates because the service handles withholding and paying the taxes for you. There are a variety of payroll products from which to choose, and one product guarantees you won’t receive any tax penalties even if you make a mistake. In addition to federal taxes, employers must calculate and apply the appropriate state and local tax rates. The math works exactly the same, but the taxes levied by each state can vary dramatically. Others have state-specific equivalents of FICA and FUTA that employers will need to apply. State unemployment tax is a percentage of an employee’s wages. Your tax rate might be based on factors like your industry, how many former employees received unemployment benefits, and experience.

How do I calculate my salary after taxes?

After-tax income = gross income-deductions. Sales tax and property tax are not included in gross income. Businesses define total revenues instead of gross revenue.

Federal payroll tax rates like income tax, Social Security (6.2% each for both employer and employee), and Medicare (1.45% each) are set by the IRS. However, each state specifies its own rates for income, unemployment, and other taxes.

Federal, state, and local withholding taxes are required in those jurisdictions imposing an income tax. Employers having contact with the jurisdiction must withhold the tax from wages paid to their employees in those jurisdictions. Computation of the amount of tax to withhold is performed by the employer based on representations by the employee regarding his/her tax status on IRS Form W-4. In 2018, the Swedish social security contribution paid by the employer is 31.42 percent, calculated on top of the employee’s salary.

How To Make Payroll Tax Payments

These taxes are imposed on employers and employees and on various compensation bases and are collected and paid to the taxing jurisdiction by the employers. Most jurisdictions imposing payroll taxes require reporting quarterly and annually in most cases, and electronic reporting is generally required for all but small employers. The employer also must pay State and Federal Unemployment Taxes .

- Under the umbrella term “payroll taxes,” employers are required to withhold state and federal income taxes from their employees’ earnings, as well as Social Security and Medicare taxes.

- These can consist of fixed charges or be proportionally linked to an employee’s pay.

- The charges paid by the employer usually cover the employer’s funding of the social security system, Medicare, and other insurance programs.

- These last two taxes are known as FICA taxes, after the Federal Insurance Contributions Act.

- The second kind is a tax that is paid from the employer’s own funds and that is directly related to employing a worker.

Only two states—California and New Jersey—tax employer and employee HSA contributions at the state level. In addition, HSA funds withdrawn for qualified medical expenses are not treated as taxable income. On Aug. 28, the IRS issuedNotice , allowing employers to suspend withholding and paying to the IRS eligible employees’ Social Security payroll taxes, as part of COVID-19 relief. Payroll taxes are part of the reason your take-home pay is different from your salary. If your health insurance premiums and retirement savings are deducted from your paycheck automatically, then those deductions can result in paychecks well below what you would get otherwise. When you start a new job and fill out a W-4 tax withholding form, your employer starts deducting state and federal payroll taxes from your earnings to pay for Social Security and Medicare. According to the US Department of the Treasury, payroll taxes made up 38.3% of federal tax revenue in fiscal year 2020.

Free Payroll Tax Calculator And Tax Rates For Every State

State agencies will generally have their own electronic or manual processes to submit state payroll taxes. The portion of payroll taxes that the employer withholds on behalf of the employee are liabilities for business accounting purposes. The employer is playing the role of an agent for the government, collecting taxes from employees and remitting them to the state and federal government. However, the matching share of FICA taxes that the employer pays on is considered a business expense, not a liability.

How can I avoid paying payroll taxes?

One way to lower your payroll tax amount is to reimburse select employee expenses such as travel, entertainment and work-related supplies. In order to have these reimbursements exempted from gross income and payroll tax you’ll have to use an accountable plan for the reimbursement.

A recent report from the Congressional Budget Office suggests that raising Social Security payroll taxes is necessary to extend the solvency of the Social Security Trust. As discussed, raising the maximum taxable income might be a complement or an alternative to raising payroll tax rates. Before 1989, the tax rate for self-employed people was less than the combined tax rate on employers and employees. The IRS recently announced that it will be cracking down on employers who don’t collect enough money in payroll taxes. The HI program is financed mainly through payroll taxes on workers.

The FUTA rate is 6.2 %, but you can take a credit of up to 5.4% for SUTA taxes that you pay. If you are eligible for the maximum credit your FUTA rate will be 0.8%. You will stop paying FUTA for each employee once his or her wages exceed $7,000 for the year. You will need to check with your state about SUTA tax rates and the wage base.

New Mexico State Income Tax

Federal individual income tax is the tax collected from individuals by the Internal Revenue Service on taxable income. The revenue collected through income tax funds federal programs such as Social Security and Medicare.

These last two taxes are known as FICA taxes, after the Federal Insurance Contributions Act. Federal payroll taxes are consistent across states, while state payroll taxes vary according to the income tax rates in each state. The Social Security tax is divided into 6.2% that is visible to employees (the “employee contribution”) and 6.2% that is visible only to employers (the “employer’s contribution”). To the extent an employee’s portion of the 6.2% tax exceeded the maximum by reason of multiple employers, the employee is entitled to a refundable tax credit upon filing an income tax return for the year.

The tax rate and cap vary by jurisdiction and by employer’s industry and experience rating. For 2009, the typical maximum tax per employee was under $1,000. Some states also impose unemployment, disability insurance, or similar taxes on employees. Because payroll taxes fall exclusively on wages and not on returns to financial or physical investments, payroll taxes may contribute to underinvestment in human capital such as higher education. Payroll taxes are the state and federal taxes that you, as an employer, are required to withhold and/or to pay on behalf of your employees. You are required to withhold state and federal income taxes as well as social security and Medicare taxes from your employees’ wages. You are also required to pay a matching amount of social security and Medicare taxes for your employees and to pay State and Federal unemployment tax.

Employers and employees each contribute 1.45 percent of the worker’s wages toward the HI trust fund for a combined rate of 2.9 percent . The cap on wages subject to the HI tax was removed in 1994. Some state and local governments have established their own tax rates withholding on wage income. Businesses and individuals living in these states have to pay this income tax, in addition to the federal income tax.

Income taxes refer to federal, state, and local taxes on an employee’s income, payable by the employee. Payroll taxes refer to taxes on the salaries and wages of employees, payable by both the employees and employers.