What is SaaS accounting: Standards, metrics & revenue recognition guidelines

The Forbes Advisor Small Business team is committed to bringing you unbiased rankings and information with full editorial independence. We use product data, strategic methodologies and expert insights to inform all of our content and guide you in making the best decisions for your business journey. For instance, if you have a SaaS product priced at $200 a month, and a client signs up for the annual plan at $2400 on May 1, your first actual revenue in May will be $200 even if you billed the client $2400. Every SaaS company needs to have the right SaaS accounting system from the first day of operation. That said, SaaS accounting can be a whirlwind for most SaaS startups and even established companies. As a growing SaaS, using spreadsheets is a slippery slope as it is time-consuming and error-prone .With scale, the revenue workflows inevitably develop some cracks and leaks.

GAAP Financial Statements & SaaS Metrics

Billing can happen weekly, monthly, quarterly, or annually, depending on the subscription model your business uses. In other words, it shows that a customer has committed to spending a certain amount of money in exchange for your services. In this accounting method, a business records revenue and expenses only when they receive payment or pay money owed. Cash-basis accounting is mainly used by companies with traditional pricing models or a smaller inventory. To run your business well, SaaS companies need to understand cash timing and their burn rates by forecasting and tracking their cash flows and expenses for cash management and financing purposes. And study your cash flow statements for issues and business trends relating to cash.

Build a Stronger Relationship with Your Revenue Leader

When considering the affordability of cloud accounting software, many providers have promotions going where the software is greatly reduced for a brief period, then goes up in price. Those that had price increases that were reasonable fared better in our ratings. Zoho does offer a forever-free plan as long as revenue falls under the threshold of $50,000 for the fiscal year. It includes one user and one accountant, the ability to manage up to 1,000 invoices a year, the ability to accept online and offline payments, a client portal, automatic payment reminders, management of 1099 contractors and more. Due to the complex nature of SaaS subscription based business models, companies face a number of SaaS accounting challenges.

Tax Compliance & Audits

Different states have different rules about collecting sales tax on products and services — sometimes very complicated rules. Anrok automates large swaths of the compliance process and syncs with Gusto, Quickbooks, Netsuite, and Stripe, among other tools. Processing payroll is an ongoing mission-critical task for any accounting team. And for a SaaS business where headcount may make up 70% to 80% of total expenses for the company, it’s among the biggest opportunities for accountants to add strategic value. Record expenses for employee compensation, payroll and other taxes, and benefits payments in your books continuously.

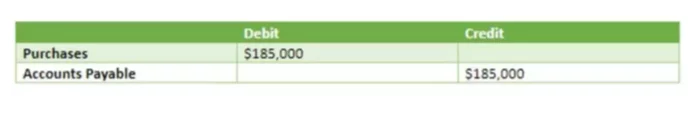

Accounts Payable Management

Like revenue, expenses are recorded when a contract is established and not when incurred. Achieving SaaS accounting goals for proper SaaS accounting treatment requires an understanding of GAAP and IFRS accounting standards and principles that apply to your SaaS company. SaaS startups, small businesses, mid-size and enterprise companies need proven accounting systems providing these features to avoid using inefficient Excel or Google spreadsheets. SaaS revenue recognition considerations include determining when to recognize revenue as current revenue on the income statement or as deferred revenue, also called unearned revenue, on the balance sheet as a liability. ASC 606 (jointly issued by the FASB—Financial Accounting Standards Board and IASB—International Accounting Standards Board) and IFRS 15 are both titled Revenue from Contracts with Customers.

What is SaaS accounting: Standards, metrics & revenue recognition guidelines

Some states provide exemptions to sales tax for software used in manufacturing or R&D operations. Accrued Revenue is treated as an Account Receivable until the customer pays the bill. However, a high Accrued Revenue signifies that the business is not getting payments for its services and can be alarming from a cash-flow perspective. If a SaaS has high bookings but lower billings, it is a leading indicator of future cash flow problems. To maintain healthy cash-flows, SaaS businesses have to think of ways to get customers to pay upfront and increase billings.

To accomplish this, reduce the deferred revenue and record current SaaS software revenue. Specialized SaaS ASC 606 and advanced ERP/accounting software systems let you automate the process. A SaaS arrangement, like those for platform-as-a-service (PaaS) and infrastructure-as-a-service (IaaS), is a cloud computing arrangement. In a software hosting arrangement, a customer obtains access to software hosted by the software vendor (or a third party on its behalf). In some hosting arrangements, the customer’s right to access the hosted software gives rise to a software intangible asset (i.e. a license).

Businesses often have their customers set up recurring credit card payments or ACH payments through their bank to pay recurring subscription charges promptly and automatically. Your company will have access to a detailed accounts receivable journal and accounts receivable aging reports. As accounts receivable are collected, the accounts receivable balance is credited, and cash is debited. In SaaS accounting, you split the revenue into these components when you initially bill the customer for the entire contract term. As time elapses, you recognize revenue currently on the income statement, in monthly increments for customer use of the software.

This is as true for SaaS accounting teams as it is for any department in the organization. [Numeric] think about the month-end close as a little bit less of a workflow and compliance process. And it’s a question of how do you ensure that these datasets that the accounting team is the owner of are correct, up to date, and complete — not just on an aggregated level, but also on a transaction level. The accounting process for a SaaS business, like any business, is a collection of recurring workflows to maintain both timely and accurate record keeping.

However in a SaaS business, all these charges are bundled into the ‘subscription fees’ or ‘set-up fees’ over the subscription fees. The success of SaaS depends on how many customers are willing to use the product on a recurring basis. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future.

Businesses using accrual accounting have the advantage of being able to defer the revenue reporting on tax returns. However, in our experience, there are limited circumstances in which a separate intangible asset that can be recognized is acquired or created. Staying on top of lease accounting compliance at a rapidly growing startup has its challenges. Its tools make it easy for finance teams to comply with new standards while also breaking down the silos between finance and real estate teams. In the world of high-growth SaaS, companies can only move as quickly and proactively as their data allows.

- GAAP regulated by the Financial Accounting Standards Board (FASB) and the IFRS, regulated by the International Accounting Standards Board (IASB) recognise revenue recognition as a core accounting principle.

- The tool can consolidate workflows (no more hunting down receipts and approvals), and makes it easy to set spending limits specific to teams and occasions.

- FreshBooks is the best overall cloud accounting software due to its plethora of features to accommodate any type of business, an easy-to-use interface and set of affordable subscription plans.

- In some SaaS arrangements, the SaaS provider may perform implementation services in addition to providing the SaaS.

Revenue recognition is a big part of the GAAP standards we mentioned above. Simply put, revenue recognition determines when payment is recognized as revenue. In short, it’s not revenue until you have fulfilled your performance obligation. Keep in mind that the IRS requires all businesses with an average of $25 million in gross revenue to operate on an accrual accounting model. ASC 606 and IFRS 15 apply to SaaS companies and to companies in other industries with customer contracts revenue.