What is the journal entry to record a gain contingency in the financial statements?

Content

A contingent gain is a potential increase in assets that has not yet occurred. A contingent gain is not recognized in the financial statements until the transaction has been settled. The $1,000,000 is considered a contingent gain, but is not reported until the lawsuit has been settled for that amount. However, it is possible to describe the nature of the gain in the disclosures that accompany the financial statements, as long as the description is not misleading regarding when the gain might occur.

Gain contingencies exist when there is a future possibility of acquisition of an asset or reduction of a liability. Typical gain contingencies include tax loss carryforwards, probable favorable outcome in pending litigation, and possible refunds from the government in tax disputes. Unlike loss contingencies, gain contingencies should not be accrued as doing so would result in recognizing revenue before it is realized.

Company

If the most likely amount is unknown, but there is a reasonably estimated range, then it is acceptable to use the range and apply the minimum limit of the range. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. This is a simplified example, but it gives you a sense of how gain contingencies work. In the real world, the specifics of accounting for gain contingencies can be complex and may require professional judgement or consultation with an accounting professional. A contingency that might result in a gain usually should not be reflected in the financial statements because to do so might be to recognize revenue before its realization.

Disclosure should be made in the financial statements when the probability is high that a gain contingency will be recognized. A gain contingency is a possible future gain, realization of which depends on future events that may be uncertain. Financial standards do not allow the recognition of gain contingencies as assets until they have been realized. A gain contingency refers to an uncertain situation that could result in an economic gain for a company if a future event occurs.

What is a Contingent Gain?

Gain contingencies are difficult to record or report, as the outcome of future events are uncertain and outside of the control of the entity. A contingency refers to a condition, situation, or set of circumstances where it is uncertain whether or not a gain or loss will occur in the future. The result of the current condition, situation, or set of circumstances, is unknown until future events occur (or do not occur). Contingencies are different from estimates, even though both involve a level of uncertainty.

Now serving in online marketing, she also has expertise in business and finance topics. Hunt received her Bachelor of Business Administration from the University of Phoenix. Hunt has also worked as a food services manager for a high school cafeteria and received her school nutrition certification in 2002. You can set the default content filter to expand search across territories. Start a free trial today and discover the power of automation at your firm.

Please Sign in to set this content as a favorite.

FASB Accounting Standards Codification (ASC) 450, Contingencies, details the proper accounting treatment for loss contingencies and gain contingencies. If a contingency may result in a gain, it is allowable to disclose the nature of the contingency in the notes accompanying the financial statements. However, the disclosure should not make any potentially misleading statements about the likelihood of realization of the contingent gain. Doing so might lead a reader of the financial statements to conclude that a gain would be realized in the near future.

Please contact us with any questions you may have regarding contingencies. We are available to discuss and help you determine how to properly account for these situations. Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory.

How to Account for Foreclosed Assets

According to accounting principles, companies are not allowed to record gain contingencies until the gain is realized or realizable. A gain contingency is an uncertain situation that will be resolved in the future, possibly resulting in a gain. The accounting standards do not allow the recognition of a gain contingency prior to settlement of the underlying event. Doing so might result in the excessively early recognition of revenue (which violates the conservatism principle). Instead, one must wait for the underlying uncertainty to be settled before a gain can be recognized. As defined by McGraw-Hill, a gain contingency is “an uncertain situation that might result in gain.” The potential gain is dependent upon the outcome of a future event.

- Disclosure should be made in the financial statements when the probability is high that a gain contingency will be recognized.

- The accounting standards do not allow the recognition of a gain contingency prior to settlement of the underlying event.

- A gain contingency is a possible future gain, realization of which depends on future events that may be uncertain.

- If the most likely amount is unknown, but there is a reasonably estimated range, then it is acceptable to use the range and apply the minimum limit of the range.

- The key accounting rule related to gain contingencies is that they should not be recognized until it is virtually certain that they will be realized.

Gain contingencies should be disclosed in the notes to the financial statements if it not misleading. Otherwise, potential gains should only be recorded to the financial statements when the activity can be recognized (i.e. the company wins the lawsuit). There is no journal entry to record a gain contingency because a gain contingency is not recorded in the financial statements. The main reason for this is because it prevents companies from recording gain contingencies to temporarily inflate the financial results. An example of a contingent gain is the prospect for a favorable settlement in a lawsuit or a tax dispute with a government entity. The ability to estimate the amount of the loss means being able to reasonably estimate the most likely amount for settlement if the event were to occur.

Hello and welcome to Viewpoint

Adequate disclosure shall be made of a contingency that might result in a gain, but care shall be exercised to avoid misleading implications as to the likelihood of realization. The supplier had breached a contract, leading to significant losses for Company XYZ. The case has gone to court, and based on legal advice, XYZ is very likely to win the lawsuit and receive substantial compensation. These materials were downloaded from PwC’s Viewpoint (viewpoint.pwc.com) under license. Janet Hunt has worked in the insurance industry for more than 15 years.

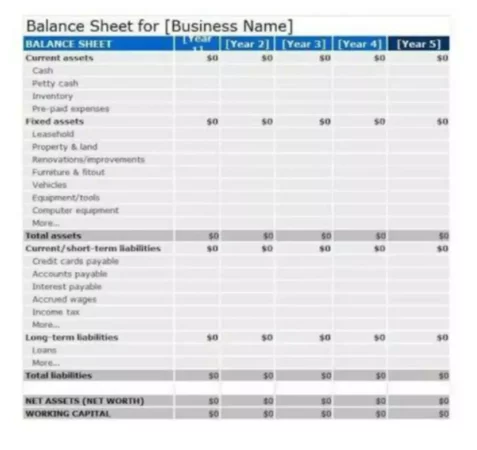

The Purpose of Gain Contingency in Business

Calculating depreciation using an estimated useful life or amounts accrued for services received are not contingencies. Despite the favorable outlook, this potential financial gain is a gain contingency. The key accounting rule related to gain contingencies is that they should not be recognized until it is virtually certain that they will be realized. This is in contrast to loss contingencies (such as potential liabilities from a lawsuit), which should be recognized as soon as they are probable and can be reasonably estimated. The financial accounting term contingency is defined as an event with an uncertain outcome that can have a material effect on the balance sheet of a company. Gain and loss contingencies are noted on the company’s balance sheet and income statement when they are both probable and reasonably estimated.