What Is Wotc Screening And How Can It Affect My Bottom Line

Content

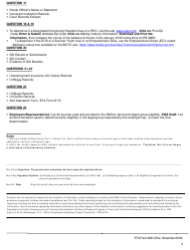

This exception applies to Form 8850’s questions asking if the job applicant is a veteran entitled to compensation for a service-connected disability. The customary practice of employers using Form 8850 is to include it among other application documents for applicant completion. If completion is in fact voluntary, and the collected information is held confidentially, such an inquiry would be covered by this ADA exception. Past correspondence on this subject, including the April 2009 informal letter from EEOC staff, indicates that using the WOTC form as instructed by the IRS is lawful under EEOC-enforced laws, but that our correspondence could not be relied upon as a defense in court.

The first page, which needs to be completed by the applicant on or before the day of the job offer, outlines the conditions that someone from one of the target groups must meet to qualify for the program. On it, they will provide their business contact information and the applicant’s key employment-related dates. On top of optimizing your WOTC program, if you want to maximize these tax credits fully, you may wish to reach out to local organizations and agencies that specialize in helping eligible individuals find work. These agencies can help increase the number of WOTC-qualified candidates that you are interviewing. Tax credits are available for both part-time and full-time new hires and are calculated based on a percentage of the wages earned and hours worked. This highest level of incentive would apply to hiring a disabled veteran who had been out of work for at least six months out of the one year before the date of Hire.

The ADA also permits employers to comply with any laws that afford individuals with disabilities equal or greater rights. Form 9062 may be presented to you by the new hire in some states, indicating the individual was tentatively determined as eligible for a WOTC target groupYou must hire the individual by the date indicated in Question 15 on this form, in order to be qualified for a tax credit. Employers who rehire a former employee, a family member or dependent, or someone who will be a majority owner in the business may not be able to claim the tax credit for that individual . Employers have 28 days from a qualified employee’s start date to send Form 8850, also known as the Pre-Screening Notice and Certification Request for the WOTC, to the applicable SWA.

Federal law prohibits an employer from claiming a tax credit under WOTC for an employee who has worked for that employer prior to the employment hiring date reported on IRS Form 8850. Employers and consultants must not submit WOTC certification requests for former employees.

What Types Of Workers Qualify For Wotc?

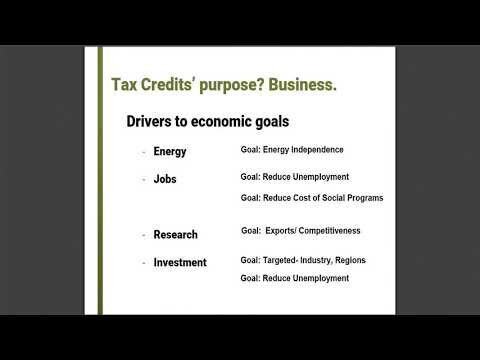

The work opportunity tax credit is a federal tax credit that’s available to employers who hire individuals from certain targeted groups. That includes people who have faced significant barriers to employment. This tax credit is meant to encourage diversity in the workplace while also making jobs more accessible to specific segments of the workforce. Employers can claim about $9,600 per employee in tax credits per year under the WOTC program.

For long-term Temporary Assistance for Needy Families applicants, credit is available to employers who hire members of this group for up to a two-year period. The Protecting Americans from Tax Hikes Act of allows eligible employers to claim the WOTC retroactively for eligible employees from targeted groups who were hired between Dec. 31, 2014, and Dec. 31, 2020. Whether a business can claim the credit is based on the category of workers it hires, the wages those workers are paid in their first year of employment, and the number of hours they work.

Additionally, there is no set limit to the number of individuals an employer can hire in order to claim the tax credit. Employers receive substantial tax credits for hiring certain applicants under the Work Opportunity Tax Credit, or WOTC, a program created by the U.S. The WOTC encourages the hiring of veterans; recipients of public assistance or food stamps; residents of empowerment, low-income zones; vocational rehab participants; released convicted felons; and people who receive Supplemental Security Income payments. As of 2020, the tax credit can save employers up to $9,600 per employee, with no limit on the number of employees hired from targeted groups. Employers may ask you certain WOTC screening questions to determine if they are eligible to apply for the tax credit. The Work Opportunity Tax Credit program is a federal tax credit available to employers if they hire individuals from specific targeted groups. The employee groups are those that have had significant barriers to employment.

Should I answer Equal Employment Opportunity questions?

Do you have to answer EEO questions? No, job seekers are not required to answer EEO questions regarding job applications and may refuse to respond if they do not want to take the survey. The process is entirely voluntary and will have absolutely no reflection on your employment, should you refuse.

The tax credit can be from $1,200 to $9,600 per qualified employee, depending on the target group. The Work Opportunity Tax Credit is a Federal tax credit incentive that employers may receive for hiring individuals from certain target groups who have consistently faced significant barriers to employment. WOTC is a Federal tax credit available to employers who hire and retain veterans and/or individuals from other target groups with significant barriers to employment. Employers claim about $1 billion in tax credits each year under the WOTC program. There is no limit on the number of individuals an employer can hire to qualify to claim the tax credit, and there are a few simple steps to follow to apply for WOTC. The tax credit employers can claim depends upon the target group of the individual hired, the wages paid to that individual in the first year of employment, and the number of hours that individual worked.

Why Do They Ask What Race You Are On Job Applications?

Or, they fail to follow up in a timely manner to meet the 28-day filing deadline. Screen all new hires to see if they qualify in any of the WOTC target groups. There is no restriction on the number of new hires who can qualify you for the tax savings. Whether your business hires 10 or 10,000 eligible employees, your tax credits will continue to pile up and improve your profit margin. By hiring individuals from target groups who meet specific criteria, an employer can receive from $2,400 to $9,600 in maximum credit per new hire, in the form of a dollar-for-dollar reduction in their tax liability.

Now that you have hired employees who make your business eligible for the tax credit, the next step is determining the amount of wages for the tax credit for each eligible employee. The wages must be paid in the first year of employment, so you will have to wait until you have one year’s pay to make the application for the tax credit to the IRS. Although you aren’t required to provide WOTC filing or other information deemed voluntary, it certainly benefits the employer if you do. Supplying the information won’t make you more qualified or a more desirable candidate, even with the possible tax credit depending on it. It’s simply a way for the employer to fulfill its obligation under the rules for federal contractors or for it to gain a generous tax credit for hiring you if you belong to one of the targeted groups of the Work Opportunity Tax Credit.

- The Work Opportunity Tax Credit is a federal tax credit incentive that congress provides to private-sector businesses for hiring individuals from any of ten target groups who have consistently faced significant barriers to employment.

- The Work Opportunity Tax Credit is a Federal tax credit incentive that employers may receive for hiring individuals from certain target groups who have consistently faced significant barriers to employment.

- The Georgia Department of Labor coordinates the federal Work Opportunity Tax Credit Program .

- This program provides employers financial incentives when hiring workers from targeted groups of job seekers by reducing an employer’s federal income tax liability.

- The objective of this program is to enable the targeted employees to gradually move from economic dependency into self-sufficiency as they earn a steady income and become contributing taxpayers, while the participating employers are able to reduce their federal income tax liability.

And you can get a tax credit worth thousands of dollars for hiring them.How does it work? It starts with keeping your eyes open for workers who just need a chance to show what they can do for you. When you re ready to hire, go to the WOTC website to check eligibility for the tax credit and for easy instructions on how to apply for it.It s a straightforward, five-step process.There are two short forms to fill out. Once they certify your application, you file for the WOTC tax credit with the IRS.And that s how you end up with a good worker and lower taxes.Up to 9600 dollars lower, for each new employee hired who meets the eligibility requirements.It s a great opportunity, and that s what WOTC s about.

For this form, you will add up all the wages of qualified workers, depending on their hours worked and their category, and multiply these amounts by the number of hours worked during the year and the appropriate percentages . For tax-exempt employers, the PATH Act retroactively allows them to claim the WOTC for qualified veterans who begin work for the employer after December 31, 2014 and before January 1, 2021. The PATH Act also added a new targeted group category to include qualified long-term unemployment recipients. The Work Opportunity Tax Credit is a Federal tax credit available to employers for hiring individuals from certain targeted groups who have consistently faced significant barriers to employment. As such, employers are not obligated to recruit WOTC-eligible applicants and job applicants don’t have to complete the WOTC eligibility questionnaire. Employers can still hire these individuals if they so choose, but will not be able to claim the tax credit.

Dol Form 9061

To calculate the credit, employers must determine the number of hours worked by the employee and their wages for the first year of employment. The amount of credit an employer can claim is limited to the amount of the business income tax or Social Security tax owed. On the other side, the biggest challenge for employers may simply be meeting the certification and filing requirements. While the paperwork involved isn’t complicated, employers have to ensure that they’re filing forms correctly and on time to pre-screen and certify workers initially. They also have to keep accurate records of their employees’ hours and wages earned in the first year of work to claim the credit. After the worker is hired, and you have received the letter from your state’s workforce agency showing that the worker qualifies, you can claim the tax credit by completing and submitting IRS Form 5884 with your business tax return.

To protect the company from claims that nonjob-related information affects employment decisions, employers print disclaimers on the questionnaires. The disclaimer says the information obtained is provided on a strictly voluntary basis and that it will not affect the hiring decision. An employer can’t demand that you provide information that isn’t a job requirement. Voluntary questionnaires by hiring companies collect data to fulfill certain record-keeping obligations under federal law, enabling it to take advantage of benefits available to employers who hire certain workers. WOTC-certified employees must work at least 120 hours during the first year of employment for an employer to claim credits, which are calculated as a percentage of qualified wages. Otherwise, you risk losing out on thousands of dollars in tax savings each year. They fail to screen job candidates and/or new hires to see whether they meet the certification criteria.

Employers are required to certify that a potential employee is a member of a targeted group in order to claim the work opportunity tax credit. That involves filling out different forms, with information from both the employee and the employer. Did you know there s a way to make a good hire for your company and lower your taxes for doing it? It s called the Work Opportunity Tax Credit, or WOTC (pronounced watt-see ).WOTC is a tax credit of up to 9600 dollars that an employer can get for hiring someone who faces a challenge getting a job.What does that mean? It means hiring certain veterans, young people, people with disabilities, people who ve received food stamps, and other people. There are details about which workers are eligible for WOTC at this website.These are people who want to get back to work and can perform well, but just need the right employment opportunity to get started.

Any business, regardless of size or industry, may be eligible to claim tax credits under the WOTC program. And because there’s no limit to the number of individuals employers can hire as part of the program, there’s also no cap on the amount of credits that they can claim. The amount of the tax credit that employers can claim depends on the target group of the individual hired, the wages paid to that individual, and the number of hours that individual worked during the first year of employment. There is also a maximum tax credit that can be earned for each target group. The credit is 25% of qualified first-year wages for those employed at least 120 hours but fewer than 400 hours, and 40% for those employed 400 hours or more. Individuals hired as Summer Youth employees must work at least 90 days, between May 1 and September 15, before an employer is eligible to claim the tax credit. The Work Opportunity Tax Credit is a Federal tax credit that’s available to employers hiring from eligible target groups, made up of individuals with significant barriers to employment.

The Work Opportunity Tax Credit is a federal tax credit incentive that congress provides to private-sector businesses for hiring individuals from any of ten target groups who have consistently faced significant barriers to employment. The objective of this program is to enable the targeted employees to gradually move from economic dependency into self-sufficiency as they earn a steady income and become contributing taxpayers, while the participating employers are able to reduce their federal income tax liability. The Georgia Department of Labor coordinates the federal Work Opportunity Tax Credit Program . This program provides employers financial incentives when hiring workers from targeted groups of job seekers by reducing an employer’s federal income tax liability.

We understand from your inquiry, and the past correspondence of others, that concern about liability remain for those who otherwise want to hire targeted workers and take advantage of the tax credit. The amount of the tax credit is based on a percentage of qualified wages paid to the new employee for the first year of employment only . Both the percentage and the cap on qualifying wages vary based on which target group the new employee falls into. For more details on WOTC benefit amounts, go to /business/incentives/opptax/. Tax credits can help businesses reduce their tax liability which can be helpful to the bottom line. That’s true for the work opportunity tax credit or any other type of business tax credit. Generally, an employer can earn a tax credit equal to 25% or 40% of a new employee’s first-year wages, up to the maximum for the target group to which the employee belongs.

The Work Opportunity Tax Credit is a federal tax credit available to employers who hire and retain qualified veterans and other individuals from target groups that historically have faced barriers in securing employment. By creating economic opportunities, this program also helps lessen the burden on other government assistance programs. The 1996 legislative provisions that apply to most adult non-veteran target groups for “qualified wages” and amount of the tax credit employers can claim for new hires certified under those target groups also apply to the new target group employees hired after December 31, 2015. The amount credit employers can claim varies and depends upon which target groups are hired, the wages paid to those individuals in the first year of employment, and the number of hours the employees worked. Indeed, older job seekers are disproportionately represented in one of the targeted groups – the long-term unemployed.

Hiring Guide For Small Businesses

Although the tax credit only applies to employers, the WOTC program may benefit employees by making career opportunities available to those who otherwise might have had a hard time landing a job. Such individuals include ex-felons, veterans and food stamp recipients. The amount of the tax credit available under the WOTC program varies based on the employee’s target group, total hours worked and total qualified wages paid.

As of 2020, most target groups have a maximum credit of $2,400 per eligible new hire, but some may be higher. Hiring certain qualified veterans, for instance, may result in a credit of $9,600 per eligible new hire. The Workforce Opportunity Tax Credit Program is a Federal tax credit available to employers for hiring individuals from certain target groups who have consistently faced significant barriers to employment. Getting the most from WOTC benefits involves managing many challenges like meeting deadlines established by law, submitting forms to state agencies, monitoring hours and wages, providing supporting documentation, and calculating tax credits. Due to complex administrative process, significant resources are required to implement the program correctly. Nevertheless, there is an easy way to avoid all the hassle with WOTC and stop missing out on tax credit opportunities. Since its beginning in 1996, the Work Opportunity Tax Credit has benefitted both employers and employees by encouraging businesses to hire individuals from certain target groups who have consistently faced significant barriers to employment.

As recognized in informal discussion letters issued in the past, the WOTC therefore does not violate the ADEA. As you know, the purpose of the WOTC is to encourage employers to hire and train people who are experiencing severe difficulties that are often linked to unemployment. For example, the WOTC program applies to people who have been long-term recipients of payments under the Temporary Assistance to Needy Families program, and to individuals who have completed or are completing certain rehabilitative services. To qualify for the WOTC tax credit for hiring people who have experienced such difficulties, the WOTC law requires employers to obtain official confirmation of job applicants’ WOTC status before the employer makes an offer of employment.

View a list of federal tax credits available to businesses and access the forms necessary to figure each credit. If the individual works at least 400 hours, the employer may claim a tax credit equal to 40% of the individual’s first year wages, up to the maximum tax credit. If the individual works at least 120 hours, the employer may claim a tax credit equal to 25% of the individual’s first year wages, up to the maximum tax credit. For all other target groups, the credit is available to employers who hire members of these groups, based on the individual’s hours worked and wages earned in the first year. With an average of 20% of those workers eligible for WOTC tax credits, that’s more than $2.4 billion in tax credits that potentially could have been claimed.

Employers have the opportunity to earn a tax credit between $1,200 and $9,600 per employee. The WOTC program has been a win-win situation for both employers and employees. Employees previously considered lacking skills and abilities or having a disability to employment simply were not hired because they were considered too much of a risk. With WOTC they get an opportunity to gain employment in what otherwise would be a losing situation. With high unemployment rates across the nation, the WOTC program continues to assist employers to boost their bottom line with millions of dollars in federal income tax savings.