What Must The Employer Do If The Employee Social Security Number Is Incorrect?

Content

WorkflowMax helps those businesses with important management functions such as tracking time, filtering job leads, generating reports, and creating invoices. Founded in 2006, Xero aims to help both business owners who want direct, real-time access to their finances, as well as accounting professionals who serve business clients. Pricing for monthly plans ranges from $19 to $39 with different features for small businesses with different accounting needs. BenefitMall has payroll services for businesses of all sizes. The company’s online service processes payroll, manages payroll taxes and offers access to payroll reports from anywhere with an internet connection. BenefitMall gives you the option of paying employees through direct deposit or by printing your own checks. Employees have online access to their payroll information.

It also offers Simon, a complete paperless payroll system that runs on mobile devices and is designed for microbusinesses with fewer than 10 employees. The Coastal Human Resource Group online payroll service allows you to submit all payroll information via the web. Payments can be made by direct deposit or paper checks that are printed by CHRG and delivered in time for your designated payday. The company also offers human resources, employee benefits, compliance screening, workers’ compensation insurance, PEO, and time and attendance services. Checkmate Payroll provides payroll services and files taxes in accordance with state and local requirements in more than 40 states.

Plus, it uses the latest encryption technology to ensure that all business and employee data stays safe. The company’s payroll solution features employee self-service, paperless payroll, payroll processing and garnishments, tax filing services, remote check printing, check calculation, and funding notification.

Payroll Systems’ paperless payroll allows unlimited payrolls, unlimited deductions and unlimited direct deposits. Payroll Systems also calculates, deposits and files payroll taxes for each client. With this system, employees can log in on their own to view and download their pay stubs and W-2 forms, access company documents, and update their contact information. Payroll Systems also offers time and attendance and benefits administration services, as well as 401 reporting and transmissions and general ledger exports. GetPayroll is an online payroll service that manages all payroll and payroll tax responsibilities for businesses of all sizes. The service offers direct deposit, customized reporting, year-end W-2 and 1099 forms, and a lifetime employee portal that allows workers to log in after they have left the company to access their information. GetPayroll features a flat-rate pricing structure that doesn’t include per-employee fees.

Best Payroll Services For 2021

The company offers direct deposit and tax filing services at no additional charge. Payroll Mate is free to try for 30 days — plenty of time to see if it’s what your business needs.

- Employees can access the system via their computers or mobile devices to see pay stubs and other important documents.

- Paysmart also prepares and files clients’ taxes and gives them the option of how their payments are made.

- These changes aim to improve the companys online accounting services so that small business owners can spend less time managing their finances and more time growing their business.

- Within the system, employers can enter payroll, add new employees and access reports.

- PaySmart offers online payroll services that allow businesses to access their payroll processing tools from anywhere they have an internet connection.

Payroll Mate also supports different types of payroll pay periods, prints checks, prepares payroll forms 941, 944, 940, W2 and W3. Payroll Mate can also generate forms California DE-6, California DE-7, Texas C-3, Texas C-4, New York NYS-45, Illinois IL-941 and Illinois UI-3/40. Payroll Mate exports payroll data to QuickBooks, Quicken and other accounting software like Microsoft Office Accounting. Payroll software is a system that handles payroll services including payroll taxes, compensation, year-end bonuses, pay stubs, paid time off, benefits management, and organizing employee records. Many organizations outsource the payroll process, but you may decide that in-house is best for your company, and there are many payroll software solutions available to streamline the task.

There is no charge for those who prefer to make their own deposits and mail or electronically file the completed forms on their own. Comprehensive payroll software that fits the needs of accountants, small and medium size businesses. Payroll Mate automatically calculates net pay, federal withholding tax, Social Security tax, Medicare, state and local payroll taxes.

How Can You Save Money On Payroll?

The company’s system allows businesses to check their payroll information on the go and compare it against the last payroll period to ensure that figures are correct prior to processing. Services include direct deposit, payroll alerts, automated reciprocity tax withholding and year-end tax form processing. CBIZ Flex-Pay Payroll Services provides checks or direct deposit to employees in all 50 states. With this service, you can call in, fax or email your payroll each period, or you can submit it online. Flex-Pay submits federal tax, federal unemployment tax, state tax and local tax withholdings information and files quarterly reports. The company also offers time and attendance and HR solutions.

The company keeps track of both your employees’ tax withholdings and your accrued employer taxes. Prior to each federal and state tax deadline, the service files all required returns on your behalf with the appropriate tax agencies.

Best Household Employers

The company also offers a combination of payroll and human resources services. TelePayroll provides a range of business services for both small and large companies. TelePayroll also collects and files taxes for any tax agency jurisdiction in the United States. Payroll4Free.com offers full-featured payroll services with professional support for free. Employers can access their data online from anywhere they have access to an internet connection. With this system, employees can be paid via printed check or direct deposit. Payroll4Free.com completes all payroll tax filings and deposits on each business’s behalf for a monthly fee of $10.

HomePay also takes care of all your year-end tax obligations. Big Fish Employer Services provides an online payroll service that manages every aspect of outsourced payroll, including calculating tax obligations, producing checks and preparing management reports. The company’s payroll service allows direct deposit and employee self-service. Big Fish also offers time and attendance and human resources solutions. Advantage Payroll Services offers a wide variety of payroll-processing technology, including proprietary software, online payroll management and a centralized data network. In addition to payroll input via PC, phone or fax, the company’s Instant Payroll product allows businesses to manage their payroll online.

Payroll information can be entered via Payright’s Evolution software or by phone, fax or email. The company also handles all payroll tax responsibilities. Heartland provides employee payroll services to businesses of all sizes. The company offers payroll processing anytime with instant online access to all payroll data and employee information.

DM Payroll Services also offers HR and time and attendance solutions. Care.com HomePay by Breedlove offers total payroll and tax-filing management. The system calculates the precise withholdings each pay period and summarizes it in a preview email right before payday. You have the option to pay your household employees either with your own checks or via direct deposit.

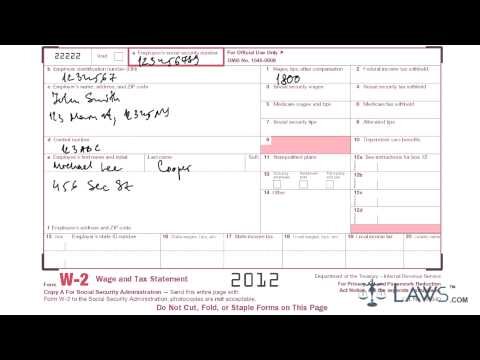

What is the W 3 form?

The W-3 form, officially the Transmittal of Wage and Tax Statements, is a summary for the SSA of all the business’ employee wages and contributions for the previous year. This summary document provides a quick overview of the W-2 forms that are attached and sent with the form every January.

In addition to its payroll services, Paysmart offers background checks and time and attendance services. These changes aim to improve the companys online accounting services so that small business owners can spend less time managing their finances and more time growing their business. RUN Powered by ADP is a popular tool that offers improved compliance tools for payroll, tax administration and employee management. This change aims to allow both business owners and accounting professionals to manage payroll and other HR tasks more efficiently. Xero also recently acquired WorkflowMax , a full-practice management suite that has allowed Xero to strengthen its cloud-based offerings.

They can also set up direct deposit and access their pay stubs online. Square Payroll handles all state and federal payroll tax responsibilities, including all the necessary withholdings, payments, and filings. In addition, Square offers employees and employers access to a full suite of benefits, including health insurance and retirement savings plans. Payright Payroll offers tailored payroll solutions for businesses of all sizes. Services include basic payroll processing and integrated solutions that incorporate payroll processing, human resources, time and attendance, and employee benefits.

Square Payroll is designed specifically for businesses with hourly employees. With this system, hourly employees can clock in and out from the register, and their hours automatically import into the system.

Does ADP file w3?

If your company has fewer than 250 employees, ADP will send copies of federal (Copy A) W-2s and federal Form W-3, Transmittal of Income and Tax Statements with your year-end reports. You must submit both forms to the Social Security Administration (SSA) using the instructions printed on your Form W-3.

PaySmart offers online payroll services that allow businesses to access their payroll processing tools from anywhere they have an internet connection. Within the system, employers can enter payroll, add new employees and access reports. Employees can access the system via their computers or mobile devices to see pay stubs and other important documents. Paysmart also prepares and files clients’ taxes and gives them the option of how their payments are made.

Wave offers integrated software and tools for small businesses, including payroll services. The payroll solution features payroll reminders and direct deposit, as well as check printing, year-end tax filings, and an employee self-service portal for pay stubs and W-2 forms. Sage is a provider of business management software and services to small and midsize businesses. The company’s payroll offerings include Sage Essentials, for businesses with fewer than 10 employees, and Sage Payroll Full Service. Sage Payroll Essentials provides unlimited processing, tax filing and direct deposit for a flat monthly fee, while Sage Payroll Full Service outsources your work to Sage’s payroll professionals.

Online payroll services give small businesses the peace of mind that, with just a few clicks, their employees will get the money they are owed and the proper payroll taxes will be withheld. This way, you don’t have to worry about whether you filed the tax documents correctly and are paying the right amounts. In fact, online payroll services are so confident in handling these tasks that most services offer an error-free guarantee. Payroll is arguably the largest expense for businesses, and running it can be a daunting task. The process can be time-consuming, and errors can result in both unhappy employees and fines. To ease the burden, many small businesses are turning to online payroll services. These services handle all of a business’s payroll processing and related tax filings and payments.