What Types Of Payment Can An Employer Use To Pay Employees?

That is not to suggest that employers must only offer two forms of payment. Each state retains the right to regulate the specific methods of payment offered to employees. Transferring money from your payroll card to a bank account can be simple or complicated, depending on which payroll card provider you choose. Surprisingly, there isn’t a lot of information out there on how to transfer funds from a payroll card to a bank account. Some services build it into their offerings, while with others, you may have to speak with your bank or payroll card provider. You shall endorse, assign and transfer to Bank all checks approved for funding.

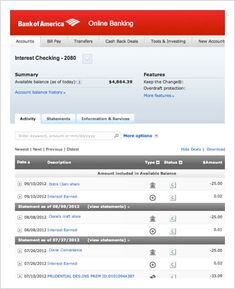

From their smart devices, employees can access pay stubs; add dependents to their health insurance; change their withholding allowances; clock in and out daily; request time off and sign up for direct deposit, by adding their banking information. Department managers can also easily view basic information for employees in their work group, and can then message them via the app. From an employer perspective, payroll cards can be a great way to securely compensate your employees while saving money on direct deposit fees and paper check overhead. Despite the growing popularity of payroll cards, federal banking laws require that employees be offered at least one additional payment option. Due to the savings of electronic fund transfers over paper checks (about $3.00 per payment, per employee), direct deposit is usually the second option.

Streamline Payroll

Payroll cards are an ideal option for small businesses looking to save money onprocessing payroll. They are also a vital tool for employees who don’t have bank accounts. Most of the large payroll processing companies offer small businesses a payroll card option.

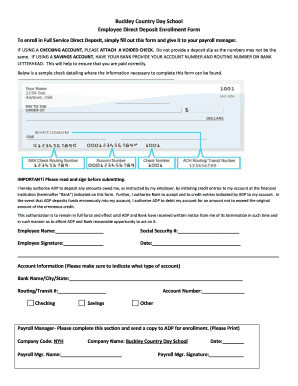

ADP is a payroll service used by many businesses to handle the payment of their employees and remains a popular method of such electronic fund transfers. The form must be signed in order for it to be considered a legal document containing the necessary authorization for such transfers. After you have enabled the integration, every time you run payroll through ADP, Plastiq will charge your credit card automatically and deposit funds into your ADP RUN account. These Terms and Conditions are the entire agreement between you, Ingo Money and Bank governing your use of Ingo. If any provision of these Terms and Conditions is held to be invalid or unenforceable, the remaining provisions will remain in full force. The waiver by either party of any default or breach of these Terms and Conditions shall not constitute a waiver of any other or subsequent default or breach.

We do not generally accept credit card checks, traveler’s checks, “starter checks” or other checks that do not have the check writer’s name and address pre-printed on the check, U.S. Savings Bonds, or checks drawn on accounts located outside of the United States or payable in currency other than US Dollars. We may or may not accept checks you have written to yourself, in our sole discretion. Depending on which payroll card service you sign up for, it may be more cost-effective to provide a payroll card option to your workers. Printing and handing out checks can be expensive, and certain payroll companies may charge extra for things like direct deposit.

Ingo money and Bank do not waive their rights by delaying or failing to exercise them at any time. Your license hereunder is limited to your use of the Ingo services through the ADP Mobile Solutions app on a mobile device that you own or control. Apple and Google are third party beneficiaries of these Terms and Conditions and may enforce them. If you select Money in Days, Ingo Money will review your check for funding approval and you shall endorse and transfer your check to Bank for deposit in Bank’s account for clearing and collection. If Ingo Money approves the check for funding and it is not returned unpaid within 10 days after submission to Ingo, Bank will credit your Card Account with the full amount of the check on the 10th day.

If your employer offers you a payroll card, it must offer you either a direct deposit or paper check option as well. There are several labor laws that require employers to provide multiple options. If you have a payroll card and you need to transfer funds to your bank account, it’s best to talk to your provider or employer. Keep in mind that you may pay a fee to transfer money to a bank account.

The employee can spend the money straight from the card or withdraw cash from certain banks and ATMs. Most payroll cards don’t require an employee to have a bank account. ADP Payroll services also enable employees to access all of the company data via the mobile app, providing a green solution for companies, as well as a cost savings, by reducing paperwork.

Terms And Conditions

You may then deposit or cash your check elsewhere. If your check clears prior to the end of the 10-day period, Bank will hold the funds until the end of the 10th day , during which time the funds will not be FDIC insured. You may send us most types of government, payroll, personal or other checks for review and approval by Ingo Money. Ingo does not generally accept credit card checks, traveler’s checks, “starter checks” and other checks which do not have the check writer’s name and address pre-printed on the check, U.S. Savings Bonds, or any check drawn on an account located outside of the United States or payable in currency other than U.S.

Paycard accounts have many of the features of a traditional bank account but also may have fewer fees. When you offer pay cards, it’s a major financial benefit for employees who don’t have a checking account. Otherwise, they could be paying $5 or more to cash each paycheck. Employees also won’t have to waste time going to a check cashing service. “Rather than spending their lunch hour running out to cash their check, they can go eat with their coworkers and pick up the bill with the pay card,” says Mavrantzas. All fees associated with the crediting of funds from your check to your Card Account through Ingo will be deducted from the amount Bank will credit to your Card Account.

How To Start Using Adp Services

The most common methods of payroll payments to employees are direct deposit, prepaid debit cards or paper check. Physical checks can be handwritten or printed and require only that your business have a checking account with a bank. You will endorse, transfer and assign all checks approved for funding to Bank for processing and funding. Bank will deposit your approved check in Bank’s account for clearing and collection, and is responsible for crediting funds from your check to your Card Account, less Ingo fees. Bank is responsible for compliance with all regulatory requirements, including but not limited to verification of your identification, money transmittal, and check cashing. Bank may outsource certain data processing, customer service and other non-financial functions to Ingo Money under Bank’s supervision, review, and approval. Employers put wages onto a reloadable card instead of cutting a paper check or making a direct deposit to an employee’s bank account.

We partner with industry experts to make payroll processing and direct deposit faster and easier for businesses. Our services also help take the guesswork out of hiring and managing employees. A paycard is a convenient way for employees to be paid. Instead of a traditional bank account, pay is deposited into the paycard account. Employees can then store or spend their money using their paycard.

- They are also a vital tool for employees who don’t have bank accounts.

- There is a host of third-party companies that can provide independent service, should your organization process payroll manually or work with a partner that doesn’t offer payroll card services.

- Most of the large payroll processing companies offer small businesses a payroll card option.

- Payroll cards are an ideal option for small businesses looking to save money onprocessing payroll.

- Payroll cards are ideal for workers with no bank account, whiledirect depositis a better option for workers who need immediate access to funds through a bank account.

Bank will deposit your check in its own account for clearing and collection and is responsible for crediting funds from your check to your Card Account . Bank is responsible for compliance with all regulatory requirements, including but not limited to, verification of your identification, money transmittal, and check cashing to the extent applicable. They function in the same manner in that a financial institution will hold the money deposited by the employer in an individual account, and the payroll card will be able to access the money much like a debit card. Alerts can be set up to notify you of low balances, or when funds become available after a deposit.

Also, payroll cards tend to be affiliated with (“branded”) one of the major credit card issuers, such as Visa, MasterCard or American Express. From a worker’s perspective, it’s important to understand the different fees associated with payroll cards, as theyaren’t exactly liketraditional debit cards. While it can be a great option for employees with no bank account, you’ll have to pay some fees, like monthly maintenance fees, ATM withdrawal fees, balance inquiry fees, fund transfer fees and account closure fees. The exact fees will depend on which company you’re working with.

There is a host of third-party companies that can provide independent service, should your organization process payroll manually or work with a partner that doesn’t offer payroll card services. Payroll cards are ideal for workers with no bank account, whiledirect depositis a better option for workers who need immediate access to funds through a bank account.

Is ADP a debit card?

The Aline Card by ADP is a reloadable prepaid Visa card that provides employers and employees a convenient, low-cost alternative to paychecks. ALINE Card by ADP® card members can quickly reactivate your card by calling 877-237-4321.

When there are material changes to these Terms and Conditions, including changes to fees, policies, transaction limits, or terms affecting your use of Ingo, you will be asked to accept such changes prior to your next transaction. If you do not agree to the changes, you will not be allowed to use Ingo.

Login & Support: Aline Card By Adp

Not long ago, physical checks or cash were the only options for paying employees. But today’s employers have many more options to choose from.

If you find the Terms and Conditions unacceptable to you at any time, please discontinue your use of Ingo. Your continued use of Ingo after we have made such changes available will be considered your acceptance of those changes. These Terms and Conditions apply solely to your use of Ingo to credit funds from approved checks using Ingo in the ADP Mobile Solutions app. Ingo accepts most types of government, payroll, personal or other checks for review and approval.

Your Ingo account and your obligations under these Terms and Conditions may not be assigned. Ingo Money and Bank may transfer their rights under these Terms and Conditions. Use of Ingo is subject to all applicable rules and customs of any clearinghouse or other association involved in transactions.