Withholding Tax Forms

Content

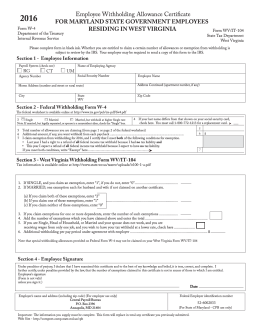

Employee’s Withholding Allowance Certificate, is a form that helps your employer determine how much federal income tax to withhold from your paycheck. With just about half the year remaining, now is a good time to check to see if you are on track to have the right amount of federal income tax withheld from your paychecks for 2016. You must complete the form in the appropriate manner to ensure that the correct amount of federal income tax is withheld.

Most taxpayers will put a number on line 5 that will help your employer calculate how much federal income tax is to be withheld from your paycheck. That number is the number of allowances you are claiming and it’s the one that gives taxpayers fits trying to get right. (If you’re using the online estimator, this number will be located under the subhed “How to Adjust Your Withholding.”) This extra withholding number goes on your W-4 form under Step 4, line 4. The 2019 W-4 is used by your employer to determine how much income tax to withhold based on your marital status and the number of withholding allowances you claim. The newly redesigned 2020 W-4 will be used by your employer to determine how much income tax to withhold based on your marital status and any other adjustments you decide to include on the form. Around this time of year, taxpayers start giving their form W-4 a second look. The form W-4 is the form that you complete and give to your employer – not the Internal Revenue Service – so that your employer can figure how much federal income tax to withhold from your pay.

Nevertheless, it is legal to have “self” and “one job” allowances from the highest paid job, provided that all other jobs have zero allowances. You are entitled to one allowance for yourself , potentially bumped depending on your job situation .

Then, depending on your individual tax return information to the IRS, you will either receive a refund from the IRS or have the opportunity to pay any extra taxes. It’s important to understand the definition of a W-4 because it is the IRS document that you complete for your employer to determine how much should be withheld from your paycheck for federal income taxes. In fact, accurately completing your W-4 and getting all questions answered can help you avoid overpaying your taxes throughout the year or owing a large balance at tax time. The W-4 Form is the IRS document you complete for your employer to determine how much should be withheld from your paycheck for federal income taxes and sent to the IRS.

Claim a high number, get more money. There is a certain amount of tax that Uncle Sam expects you to pay each year, whether it comes out of your paycheck each pay period or is paid when you file your 1040 form by April 15th. When you’ve claimed fewer exemptions than you should , then money will be refunded to you after filing your taxes. Neither situation is good for you. The simplest way to correct for underwithholding or overwithholding is by turning in a new Form W-4 (Employee’s Withholding Allowance Certificate) to your employer. Taking this action will adjust the amount of federal income tax that is withheld from your paychecks for the rest of 2016.

You can claim one withholding allowance for each exemption you expect to claim on your tax return. The more allowances you claim on Form W-4, the less income tax your employer will withhold. You will have the most tax withheld if you claim “0” allowances. The number of allowances you can claim depends on the following factors. One common mistake made is when a taxpayer has a full-time job and a part-time job.

Specifically, you can adjust your withholding by increasing or decreasing the number of allowances claimed on your Form W-4. The more allowances claimed, the lower the withholding from each paycheck, and vice versa. If claiming zero allowances for the rest of the year would still not result in enough extra withholding, you can ask your employer to withhold an additional amount of federal income tax from each paycheck. Whether you’re filling out paperwork for a new job or got an email notification from HR, you might have noticed that the W-4 form changed from what you might have been used to. Valid for 2017 personal income tax return only.

Irs Form W4: For New Hires And Every Time Your Tax Situation Changes

Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules.

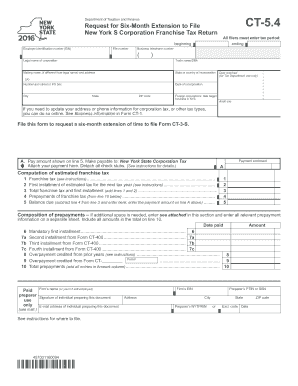

Alternatively, or in addition, the employee can send quarterly estimated tax payments directly to the IRS (Form 1040-ES). Quarterly estimates may be required if the employee has additional income (e.g. investments or self-employment income) not subject to withholding or insufficiently withheld. Quarterly payments can also be required for a few years as a penalty for under withholding more than a nominal amount. There are specialized versions of the W-4 Form for other types of payment; for example, W-4P for pensions, and the voluntary W-4V for certain government payments such as unemployment compensation. When you hire employees, you should have them complete Form W-4 when they start work. The form lets you know how much federal income tax to withhold from employees’ wages.

Tax Services

The amount of income tax withholding must be based on filing status and withholding allowances as indicated on the form. If a new employee does not give you a completed Form W-4, withhold tax as if he or she is single, with no withholding allowances. Additional withholding may be required on wages paid to non-resident aliens. An exemption affects the amount of taxes withheld from your paycheck. Generally, the more exemptions you claim, the less federal income tax your employer will withhold from your paycheck, creating a larger take-home paycheck.

You will use the information employees input on Form W-4 to calculate their federal income tax withholding. You can use the withholding charts in Publication 15 or payroll software to calculate income tax withholding. Employees should fill out Form W-4 when they first begin work for your business. You will then use each employee’s Form W-4 to calculate how much federal income tax withholding to deduct from wages, beginning with the next payroll you run. You definitely don’t want to file exempt if you’re not actually exempt, though. You won’t have any federal income tax withheld from your paycheck, so when you do your taxes in April, you’ll have a giant tax bill that includes late payment penalties.

Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Must provide a copy of a current police, firefighter, EMT, or healthcare worker ID to qualify. No cash value and void if transferred or where prohibited. Offer valid for returns filed 5/1/ /31/2020. If the return is not complete by 5/31, a $99 fee for federal and $45 per state return will be applied.

Do Nonresident Aliens Fill Out Form W

The Send A Friend coupon must be presented prior to the completion of initial tax office interview. A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office.

Employers.To know how much income tax to withhold from employees’ wages, you should have aForm W-4, Employee’s Withholding Allowance Certificate, on file for each employee. Ask all new employees to give you a signed Form W-4 when they start work. Make the form effective with the first wage payment. If employees claim exemption from income tax withholding, they must indicate this on their W-4.

- Make the form effective with the first wage payment.

- Employers.To know how much income tax to withhold from employees’ wages, you should have aForm W-4, Employee’s Withholding Allowance Certificate, on file for each employee.

- Ask all new employees to give you a signed Form W-4 when they start work.

- If employees claim exemption from income tax withholding, they must indicate this on their W-4.

The problem with the second job is that each employer will withhold taxes as if the employee only had one job. When the income from the two jobs is added together, the taxpayer is often in a higher tax bracket and will not have had enough taxes withheld for the higher income level. For this reason the taxpayer needs to adjust their withholdings to ensure an adequate federal/state tax is withheld to avoid a balance due.

Get More With These Free Tax Calculators And Money

Accurately completing your W-4 will help you avoid overpaying your taxes throughout the year or owing a large balance at tax time. The W-4 is based on the idea of “allowances”; the more allowances claimed, the less money the employer withholds for tax purposes. The W-4 Form is usually not sent to the IRS; rather, the employer uses the form in order to calculate how much of an employee’s salary is withheld. An employee may claim allowances for oneself, one’s spouse, and any dependents, along with other miscellaneous reasons, such as being single with only one job. In the latter case, this creates an oddity in that the employee will have one more exemption on the W-4 than on the 1040 tax return. This is not a tax deduction in itself, but a procedure to prevent under-withholding for those who do not qualify.

OBTP#B13696 ©2017 HRB Tax Group, Inc. IRS Form W4 helps employers to withhold the correct amount of federal income tax from your pay. At the end of the tax year, the withheld funds will be released to the IRS.

If you want your federal income tax withholding to be more accurate, you should fill out a new Form W-4. This will likely result in a change in your federal income tax withholding, which impacts the amount of your usual tax refund or the amount you usually owe. Ask your payroll or human resources department how to submit a new Form W-4. Tax withholding depends on the employee’s personal situation and ideally should be equal to the annual tax due on the Form 1040. When filling out a Form W-4 an employee calculates the number of Form W-4 allowances to claim based on their expected tax filing situation for the year. No interest is paid on over-withholding, but penalties might be imposed for under-withholding.

Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visit hrblock.com/ez to find the nearest participating office or to make an appointment.

You are also entitled to one allowance for your spouse and one allowance for each dependent you report on your tax return . You can claim additional allowances if your filing status is “head of household” or if you expect to claim a tax credit for child care expenses . You may also claim additional allowances if you will claim the child tax credit . The total of those lines gives you the total maximum allowances you can claim. You do not have to claim the maximum if you don’t want to. Remember that the more allowances, the less withholding. Most taxpayers, however, are not exempt.

If you are exempt from tax withholding, you only need to complete Step 1, Step 1, and Step 5 — and then you can write “Exempt” on Form W-4 in the space below Step 4. Generally, you can only claim exempt if you don’t have any tax liability, meaning you didn’t owe any tax last year due to earning income, or you didn’t need to file a tax return at all.