Work-in-Progress WIP Definition With Examples

Content

The term work-in-progress (WIP) is a production and supply-chain management term describing partially finished goods awaiting completion. WIP refers to the raw materials, labor, and overhead costs incurred for products that are at various stages of the production process. WIP is a component of the inventory asset account on the balance sheet. These costs are subsequently transferred to the finished goods account and eventually to the cost of sales. You calculate work-in-progress (WIP) as the cost of unfinished products through production.

Finally, when the product is sold, it moves from a form of inventor to cost of goods sold (COGS) on the balance sheet. The terms work-in-progress and finished goods are relative terms made in reference to the specific company accounting for its inventory. It’s incorrect to assume that finished goods for one company would also be classified as finished goods for another company. For example, sheet plywood may be a finished good for a lumber mill because it’s ready for sale, but that same plywood is considered raw material for an industrial cabinet manufacturer. The difference between WIP and finished goods is based on the inventory’s stage of relative completion, which, in this instance, means saleability.

What Does Work-in-Progress Mean in Accounting?

It is a concept used in calculating the cost of goods sold and inventory, which are essential components of a company’s financial statements. It represents resources that convert into finished products and services. If you run a manufacturing business, you need to keep track of your work in progress inventory, or WIP.

This article explains what WIP means in an accounting context and provides examples of how it is used in practice. Accounting is a complex field, and the terms used in day-to-day business activities can be challenging to understand, especially in manufacturing. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Why You Can Trust Finance Strategists

WIP accounting also does not include costs for finished items, which are classified as finished goods inventory after they have moved past the production floor. The estimated product value includes raw materials, overhead costs, and labor. WIP accounting does not include costs for items that have not entered the production assembly line. For example, raw materials that are still placed in factory stores are not included in WIP costs. Closing entries help you prepare your financial statements and measure your performance for the period.

Since the combs are only partially completed, all costs are posted to WIP. When the combs are completed, the costs are moved from WIP to finished goods, with both accounts being part of the inventory account. Costs are moved from inventory to cost of goods sold (COGS) when the combs are eventually sold. It describes goods that are partially finished and awaiting completion. WIP refers to production aspects like raw materials, labor costs, and overhead costs.

- It is because labor, materials, and overhead costs can vary significantly from one software project to the next.

- The formula to calculate WIP is WIP Inventory + Direct Labor Costs + Overhead costs.

- Accounting is a complex field, and the terms used in day-to-day business activities can be challenging to understand, especially in manufacturing.

- Total WIP Costs are calculated as a sum of WIP Inventory + Direct Labor Costs + Overhead costs.

However, many wonder whether WIP can be considered income despite its importance. The answer depends on various factors, such as when the work was started, when it was finished, and whether the customer paid for it. For example, construction contractors would use WIP to determine how much of a project had been completed and how much remained unfinished at any given time during construction when submitting bids. This inventory stays on a company’s balance sheet or is written off based on the duration of time it spends on the production floor.

How do you calculate WIP inventory?

WIP inventory is important because it affects your cost of goods sold (COGS), which is the cost of the goods that you sold during the period. COGS is calculated by subtracting your ending inventory from your beginning inventory plus your purchases. If you do not account for WIP inventory, you may understate or overstate your COGS and your gross profit. Generally, the amounts in work-in-process (WIP) are relatively small compared to a manufacturer’s cost of goods sold and its finished goods inventory. Work-in-process (WIP) inventory pertains to the goods for which the manufacturing has begun, but not yet completed. In conclusion, Work in Progress (WIP) is an important concept to understand within accounting.

- ABC already has $100,000 worth of raw material inventory left over from the previous year and makes additional purchases of $300,000 to manufacture new television sets for this year.

- Let’s say you are working on a software development project with five tasks – task A, B, C, D, E – with estimated durations of 1 hour, 2 hours, 3 hours, 4 hours, and 5 hours respectively.

- It helps reduce waste by ensuring that no material is wasted by being left unused when it could have been put back into production instead.

- Understanding a company’s work in progress (WIP) is one of the most reliable ways to keep an eye on the production capacity utilization of the company as well as the progress being made in production.

- It allows staff members to monitor their current functions by creating cards or “work items.”

WIP was vital in industrial production, requiring multiple steps to make a finished product. ABC has five workers on its assembly line and they are each paid an annual salary of $40,000. As such, the difference between WIP and finished goods is based on an inventory’s stage of completion relative to its total inventory. WIP and finished goods refer to the intermediary and final stages of an inventory life cycle, respectively. Use the term work-in-progress is for products that have a longer production time. Work-in-process is the same thing, but with a faster turnaround time.

To see our product designed specifically for your country, please visit the United States site. If we enter those inputs into our WIP formula, we arrive at $25 million as the ending work in progress (WIP), reflecting an increase of $5 million in WIP from the beginning to the end of the period. For instance, the WIP inventory could be undergoing finishing touches prior to being marked as complete. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

A piece of inventory is classified as a WIP whenever it has been mixed with human labor but has not reached final goods status. WIP, along with other inventory accounts, can be determined by various accounting methods across different companies. Another popular accounting software program is Xero, which offers similar features as QuickBooks but targets larger businesses with more advanced accounting needs. It provides an online platform where users can enter their business data and view real-time updates regarding their financials. In addition, the WIP report measures the company’s progress and provides an indicator of the company’s financial health. For example, if a company has WIPs that equal 100% of its production capacity, it can say that its current projects are being completed on time and within budget.

What Does Work in Progress (WIP) Mean in Accounting?

It also integrates with various third-party applications, such as banks and credit card processors, to facilitate payments and allow users to keep track of all expenditures related to specific projects. Xero’s reporting features are robust enough to produce detailed WIP reports for any size project or organization. It can be tracked throughout completion until they reach the “done” stage. This type of WIP tracking allows organizations to monitor their progress toward meeting project deadlines and report on the progress. In construction projects, WIP tracks progress for billing purposes and determines when certain milestones are achieved.

Total WIP Costs are calculated as a sum of WIP Inventory + Direct Labor Costs + Overhead costs. These expenses cannot be moved elsewhere or re-invested into other departments within the manufacturing setup. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

The WIP figure reflects only the value of those products in some intermediate production stages. This excludes the value of raw materials not yet incorporated into an item for sale. The WIP figure also excludes the value of finished products being held as inventory in anticipation of future sales. When you complete the manufacturing process, the data moves over to the finished goods account sheet.

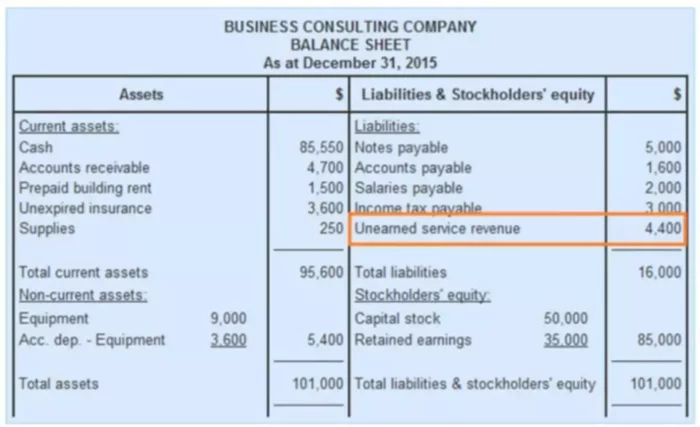

WIP refers to the intermediary stage of inventory in which inventory has started its progress from the beginning as raw materials and is currently undergoing development or assembly into the final product. Finished goods refer to the final stage of inventory, in which the product has reached a level of completion where the subsequent stage is the sale to a customer. Thus, it is important for investors to discern how a company is measuring its WIP and other inventory accounts. Allocations of overhead can be based on labor hours or machine hours, for example. It is standard practice to minimize the amount of WIP inventory before reporting is necessary since it is difficult and time-consuming to estimate the percentage of completion for an inventory asset. To report WIP inventory, you need to include it in your balance sheet as part of your current assets.

The most popular of these is QuickBooks, explicitly designed for small businesses and individuals who need to track their finances. It has features such as invoicing, job tracking, time tracking, purchase orders, accounts receivable and payable, inventory tracking, budgeting tools, sales tax filing tools, employee data management, and more. Overall, having little work in progress on a company’s books can adversely affect its financial statements in both short-term and long-term situations.

WIP is one of the three types of inventory, of which the others are raw materials and finished goods. Generally speaking, both types of assets need to be tracked for accurate financial reporting, as they can significantly affect a company’s financial performance if not correctly accounted for. A WIP inventory helps to identify any bottlenecks or inefficiencies in production, allowing for enhanced optimization of resources across all stages of the manufacturing process. The ability to monitor each step of the process gives businesses a better understanding of potential areas for improvement to maximize efficiency and throughput. With QuickBooks, you can easily manage financial processes, such as billing clients for completed work or reimbursing employees for project expenses.