Working As An Enrollment Specialist At Adp

Content

To make the best health care choices for themselves and their dependents, employees need to carefully consider all of these questions during the open enrollment period. HR leaders can help make their decision easier by providing the answers to these questions in writing and by making themselves available to explain further or answer any questions.

Late fall has become the traditional time of year for many employers to offer enrollment for health benefits coverage, tying in with the open enrollment period for Affordable Care Act health plans. That way, employees know they can put in the time once a year to make selections and they likely won’t have to worry about it again for 12 months. The agreement between Voya and ADP will streamline implementation, making benefits administration more efficient and cost-effective. With the integrations, employers can now more easily select the policies and coverages they would like to offer their employees, and quickly plug their selections into ADP’s benefits administration system. Employees can switch plans during health insurance open enrollment. You may offer health plans with varying deductibles, copays, coverage, and premiums.

They can also impose caps on the benefits the insurance plan will pay. These special enrollment periods also apply in the individual market. During an open enrollment period, eligible individuals can opt-in or out of plans, or make changes to the plan they currently have. Rates are reassessed during this period, and health plan prices are often altered for the coming benefit year (this usually corresponds to the calendar year, but in the case of employer-sponsored plans, it doesn’t have to). The benefits broker community relies on EBA to stay connected through its website comment forums, its social media communities and live events. Insurance is underwritten by ReliaStar Life Insurance Company and ReliaStar Life Insurance Company of New York, members of the Voya® family of companies. Generally, open enrollment does not apply to small business retirement plans for employees.

What happens if you don’t have health insurance and go to the hospital?

However, if you don’t have health insurance, you will be billed for all medical services, which may include doctor fees, hospital and medical costs, and specialists’ payments. Without an insurer to absorb some or even most of those costs, the bills can increase exponentially.

But in nearly every state, people who don’t have health insurance as of early 2021 have been given another opportunity to obtain coverage, even if they don’t have a qualifying event. Due to the ongoing COVID-19 pandemic, the Biden Administration has announced a one-time special enrollment period on HealthCare.gov.

Cost Of Care

Many employees are reticent to spend time poring over benefit plans and policies, but their choices can significantly affect their medical expenses during the year. If nothing has happened to trigger a special enrollment period, you will most likely have to wait until the next open enrollment period to sign up for health benefits or make a change to your existing benefits. If you get your health benefits through your job, your annual open enrollment period may last a few weeks or often a month. The open enrollment period typically occurs sometime in the fall, but employers have flexibility in terms of scheduling open enrollment and their plan year, so it doesn’t have to correspond with the calendar year.

What do I do if I don’t have a 1095 A form?

Q: What should I do if I don’t receive a Form 1095-A? If you purchased coverage through the Marketplace and you have not received your Form 1095-A, you should contact the Marketplace from which you received coverage. You should wait to receive your Form 1095-A before filing your taxes.

One way in which small businesses can supply health care benefits without breaking the bank is by establishing employee health savings accounts . These accounts allow employees to contribute pretax funds toward the costs of specific treatments or services. If it’s within your means, you can sweeten the deal by contributing some seed money into each employee’s account. If your employer health plan doesn’t cover dental health, chiropractic visits or vision, employees may want to add those services during the open enrollment period.

That, in turn, can make it easier for companies to control their health plan costs and keep them under the Cadillac Tax threshold, he said. “Many companies today are exploring new models for administering health benefits to their employees and looking for innovative ways to reduce the costs of their health plans in order to avoid the Cadillac excise tax.” Especially after a significant health crisis and all its related disruptions upon you and your business, it may be a good time to revisit your employee benefits offerings.

World Mental Health Day

By offering this benefit, you can stand out among your competitors and help attract talent. Furthermore, these types of plans help you ensure that your workforce has access to preventative care, which may help lead to fewer sick days down the line. As we’ve recently learned, preventive healthcare has never been more important. Once employees have selected their health care coverage options during this period, they are generally unable to change their plans until the following year’s enrollment period. However, an employee may be eligible for a special enrollment period if they experience certain life events like getting married, having a baby or adopting a child. Each year, employees have an opportunity to change their health care coverage during the “open enrollment period.” Employers set the dates for this period, but many do it during the fall and plans run from January 1 to December 31. As of 2021, there is a penalty for being without minimum essential coverage in New Jersey, DC, Massachusetts, California, and Rhode Island.

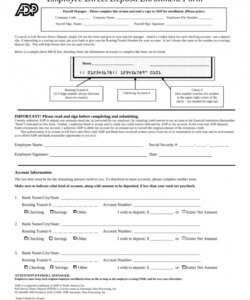

Eligible employees can enroll in insurance benefits online via ADP within 30 days of their hire date or status change date. A Benefit Guide will be emailed to them before their enrollment period and will include plan information as well as enrollment instructions. ADP said it will offer a private health exchange option to companies that want to continue providing their employees’ group health insurance coverage. Workers at those companies will be able to shop on that exchange for a range of coverage options—with different price points and benefits—in contrast to the typical one or two choices that many larger employers offer. The Affordable Care Act requires health plans to provide a Summary of Benefits and Coverage and make available upon request a uniform glossary of terms commonly used in health insurance during open enrollment.

- That way, employees know they can put in the time once a year to make selections and they likely won’t have to worry about it again for 12 months.

- You may offer health plans with varying deductibles, copays, coverage, and premiums.

- Late fall has become the traditional time of year for many employers to offer enrollment for health benefits coverage, tying in with the open enrollment period for Affordable Care Act health plans.

- With the integrations, employers can now more easily select the policies and coverages they would like to offer their employees, and quickly plug their selections into ADP’s benefits administration system.

- Employees can switch plans during health insurance open enrollment.

- The agreement between Voya and ADP will streamline implementation, making benefits administration more efficient and cost-effective.

Small businesses’ employees make up the majority of the “working uninsured” according to the Kaiser Family Foundation. This lack of health care coverage doesn’t just pass insurance costs onto employees. It can have a negative impact on an company’s employee retention rates. With the cost of benefits being number two on the list, it’s easy to see how open enrollment can play a part in alleviating the problem. Many HR teams struggle with health care costs and compliance, and it’s time for finance leaders to step in and look for ways to collaborate with their peers to find business-enabling solutions.

Preventive Care

A qualifying event is not necessary in order to sign up during this window. Make sure to distribute and collect benefit enrollment forms from employees during open enrollment. Not only do you need enrollment forms to make changes to their plans, but you also need these forms to store in your records. As an employer who offers insurance benefits, you are responsible for conveying benefit-related information to employees during open enrollment. ADP’s private exchange for health insurance will service employers who have workers typically ineligible for company health benefits. Insurance plans elected during Open Enrollment are effective on September 1 of that year. Coverage effective dates for mid-year entries due to Qualifying Events vary.

So start presenting information about open enrollment well before the period begins to get it on employees’ radars. From there, send out regular communications until open enrollment ends. Leverage different methods like emails, flyers and in-person meetings. In previous years when open enrollment rolled around, many employees just automatically re-enrolled in their previous year’s plan.

If you miss your company’s open enrollment period for health insurance benefits, you may be out of luck. If you have not already signed up for health insurance, there’s a good chance you won’t be able to do so this year. But if you were already enrolled last year, your plan likely automatically renewed for this year if you didn’t make any changes during your employer’s open enrollment period. Each year, employers with more than 50 employees that offer health benefits must offer an “open enrollment” period.

Send these communications several weeks prior to open enrollment. To learn more about providing health and benefits coverage to employees at your small business, check out the Health & Benefits Coverage 101 Small Business Guidebook. It takes time to read through the details of benefits plans and options, not to mention the back-and-forth of getting answers to questions. Employees need more than a few hours or even a few days to do it well.

Under specific circumstances, employees can make changes to their insurance plans outside of the open enrollment period. When an employee has a qualifying life event, they have a limited amount of time to add, remove, or cancel coverage. According to the National Federation for Independent Business , only 35 percent of firms with fewer than 50 employees provide health insurance.

HR leaders, though, know that’s not the best option nor the option employees are likely to choose this time around. We’ve struggled through a global health crisis, plans change every year, life circumstances shift often and the options may include new benefits that weren’t available previously. HR leaders should be ramping up their efforts to help employees make the best decisions during this period by arming them with the information they need.

The SBC must be provided no later than the first day of open enrollment and included in any written enrollment materials. For self-insured and level-funded plans, the employer is responsible for preparing the SBC. Employers with fully-insured plans should coordinate with their insurance company to ensure that the SBC is provided. Instruct employees to review the SBC for questions about deductibles, out-of-pocket expenses, and the costs and limitations associated with various types of medical events. Instead of just rolling over the previous year’s selections, some employers require employees to actively choose their benefits during open enrollment or they won’t receive those benefits in the following year. Even if you don’t follow this practice, encourage employees to take into account past usage and to select the option that best fits their current needs.

Make sure employees know how much they need to contribute each pay period to the plans. And, explain out-of-pocket expenses employees may need to pay when they seek medical care.

Remind employees that their benefit elections will generally remain in place for an entire year. This means that if their choice is too expensive for their budget or doesn’t meet their needs, they will generally have to wait until the next open enrollment period to make changes. Open enrollment is also a good time to remind employees to make sure their beneficiaries and contact information are up to date. Whether you provide health insurance benefits through a private plan, a self-insured plan, or through the Small Business Health Options Program , notify employees early that open enrollment is coming. Summarize benefits choices and any changes from the previous year so that employees can start to think about their options.

Employees can make changes to their small business retirement plans at any time during the year. During open enrollment, employees can make changes to any insurance-related plans you offer, including health, vision, dental, life, and disability insurance plans. Discuss which employees are eligible for adding insurance benefits. When integrated with ADP’s Health Compliance tool, the ADP Private Exchange will enable employers to identify which employees are and are not eligible for health benefits. Powered by ADP’s human resources and payroll data, employers can now direct employees working less than 30 hours per week who are not eligible for benefits to GoHealth for public exchange enrollment.

With your employees being so essential to your success, retaining talent through offering them the benefits that address their needs and preferences remains strategically important. The benefits you offered a few months ago may no longer be giving you the return on investment you expect today.

ADP’s exchange is powered by GoHealth, which will service ADP’s employer clients that have part-time, temporary, or contract workers who are typically ineligible for employer-sponsored health insurance. ADP has joined the growing number of companies offering private benefits exchanges to give employees wider choices for health care coverage and other benefits. Following IRS regulations, you can make changes to your benefits that are consistent with your life or family status changewithin 30 days of the date that the status change occurred. If you miss the 30-day enrollment period, you must wait until the next Open Enrollment to make changes.

A special enrollment period could be triggered if you are covered under someone else’s plan and lose that coverage. For example, if you are covered under your spouse’s plan and your spouse loses her job or you get divorced, this would trigger a special enrollment period that would allow you to enroll in your company’s health plan right away. Most of the state-run exchanges have followed suit, opening special enrollment windows. Some apply to anyone eligible to use to use the exchange, while others are only available for uninsured residents.

Open enrollment is an annual period where individuals can enroll in, make changes to, or cancel their insurance plans. Open enrollment applies to employees who want to make changes to their employer-sponsored insurance as well as individuals who participate in the government’s Marketplace health plans. Typically, employees are not allowed to change their insurance plans outside of open enrollment. If it’s not within your means to offer full insurance benefits to your employees, you may want to consider investing in shared-cost plans. By having staff members foot a portion of the bill — say 10 or 20 percent — you may be able to offer better coverage to your whole team.

Provide them with information about what is available and how much it will cost them. Of the plans that aren’t minimum essential coverage, short-term plans tend to be the closest thing to “real” insurance.