WRITE-UP SERVICE DEFINITION

Content

The difference between the purchase price and assets’ fair value is $ 20 million will be recorded as Goodwill. During an asset write-up, special treatment for intangible assets and tax effects are considered. With an asset write-up, the deferred tax liability is generated from additional (future) depreciation expense. BANKER’S ACCEPTANCE (BA) is a money market instrument that is issued in discounted form. A banker’s acceptance is created when a bank accepts responsibility for payment of business debt by signing a letter of credit. Banker’s acceptances are sold to acceptance dealers and may be resold to numerous other parties before the loan is repaid.

This is a relatively low value-added activity, so the fee charged to the client for this service is generally low. For example, assume Company A is acquiring Company B for $100 million, at which point the book value of Company B’s net assets was $60 million. Before the acquisition can be completed, Company B’s assets and liabilities have to be marked-to-market to determine their fair market value (FMV). As the result, the market value of the asset is equal to $ 180 million which led to the write-up of $ 30 million.

Want to learn more about how we help clients with our services?

The difference of $15 million between the FMV of Company B’s assets and the purchase price of $100 million, is booked as goodwill on Company A’s balance sheet. Whereas a write-down is generally considered a red flag; a write-up is not considered a positive harbinger of future business prospects — since they’re generally a one-time event. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years.

The investor who last owns the acceptance when the debt becomes due has a right to collect from the borrower. Should the borrower default, the investor can also pursue payment from the accepting bank. All content on this website, including dictionary, thesaurus, literature, geography, and other reference data is for informational purposes only. This information should not be considered complete, up to date, and is not intended to be used in place of a visit, consultation, or advice of a legal, medical, or any other professional. If the FMV of Company B’s assets is determined to be $85 million, the increase in their book value of $25 million represents a write-up.

Bookkeeping and Write-Up Services for Your Business

A write-up is an increase made to the book value of an asset because its carrying value is less than fair market value. A write-up generally occurs if a company is being acquired and its assets and liabilities are restated to fair market value, under the purchase method of M&A accounting. It may also occur if the initial value of the asset was not recorded properly, or if an earlier write-down in its value was too large. By utilizing these write-up services, you can reduce the stress related to accounting and finances and ensure accuracy of all your financial reports and records. Write-up work is the accounting service that prepares the financial statement for the client.

- As the result, the market value of the asset is equal to $ 180 million which led to the write-up of $ 30 million.

- Whereas a write-down is generally considered a red flag; a write-up is not considered a positive harbinger of future business prospects — since they’re generally a one-time event.

- Before the acquisition can be completed, Company B’s assets and liabilities have to be marked-to-market to determine their fair market value (FMV).

- We are proud to serve organizations throughout eastern North Carolina with professional, reliable bookkeeping and write-up services.

- Banker’s acceptances are sold to acceptance dealers and may be resold to numerous other parties before the loan is repaid.

- The consultant has simply recorded the transaction base on whatever the client provides.

Auditor will pay much attention to the write-up as it suddenly increases company assets. Write-up is the accounting method in which company increases its asset book value when it decreases below the market value. It is different from the revaluation method as write-up only incurs during the business acquisition. This method used when the company assets are not properly recorded in the initial recognition.

WRITE-UP SERVICE Definition

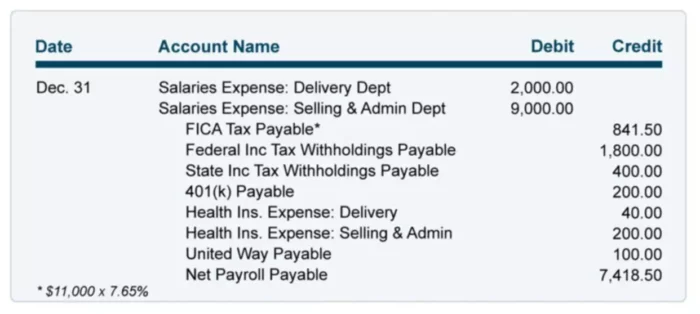

The company hires an external account to prepare the financial statements for them, but this service does not include any review or audit of the information. The consultant has simply recorded the transaction base on whatever the client provides. They do not review or audit the transaction, so any mistake or error will not be detected. The financial statements are not reliable, and require further review from another qualified accountant/auditor. The write-up will impact assets on the balance sheet, it requires a professional judgment to prevent any window dressing financial statements.

- This method used when the company assets are not properly recorded in the initial recognition.

- A banker’s acceptance is created when a bank accepts responsibility for payment of business debt by signing a letter of credit.

- The company hires an external account to prepare the financial statements for them, but this service does not include any review or audit of the information.

- Write-up work is the accounting service that prepares the financial statement for the client.

- The difference of $15 million between the FMV of Company B’s assets and the purchase price of $100 million, is booked as goodwill on Company A’s balance sheet.

We are proud to serve organizations throughout eastern North Carolina with professional, reliable bookkeeping and write-up services. The preparation of financial statements from a client’s information and without any review or audit of the amounts. Because a write-up impacts the balance sheet, the financial press does not report on more mundane instances of businesses initiating a write-up of asset values.

Write-Up Services

In contrast, sizable write-downs do spark investor interest and make for better news cycles. Your HBK team works with you to unburden you from time-consuming financial data practices, allowing you to focus on growing your business. Write-up work involves the preparation of financial statements for a client without first reviewing or auditing the underlying information.