Year End Payroll And Tax Checklist

Content

There are many different payroll software companies you can use to process payroll but ADP does an exceptional job at helping your company process payroll. ADP can help payroll professionals grow along with company changes. They can also help payroll professionals stand out as people that employees, managers and department heads trust to get their pay checks right. After your employee’s track time, you can review the timesheets and make any changes you need. Just press the Export to ADP button and your timesheets are now in your ADP payroll.

Employees can log in to the system and enter their timecard information, hours and any other relevant payroll information. This data is automatically uploaded to your paydata grid.

Access And Integrate Data And Analytics From Across All Areas Of Your Business

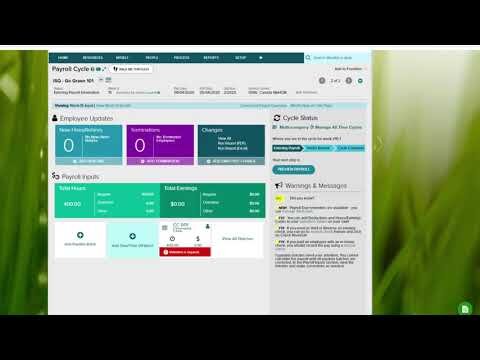

To use ADP for payroll, start by making a new payroll cycle to clear out any old data. Once the popup window closes and the new payroll cycle page returns, you can set up the employees who are to be paid by clicking on “Process” in the task bar. Then click “Enter Paydata” and select “Paydata” from the popup menu. Your company may employ salaried employees or hourly employees who work a fixed number of hours each pay period.

The office, coffee shops, your comfy yoga pants. With Time Tracker, your employees can track time from anywhere. As the admin, you can approve your employee’s time entries and sync them to RUN Powered by ADP in a single click. You’ll spend less time hunting down paper timesheets and be able to quickly process payroll.

Automated Payroll

Information for that employee’s regular pay for this pay period is already entered. Now, enter a second row for that employee to create a new check. Click on “insert” and select “new row.” A second row will appear with the same employee name.

This is the process for entering data for your salaried and hourly employees who are not set up for Automatic Pay. You enter paydata in batches, which are groups of employees. You can use previously-created batches, or you can create and customize new batches.Click on “Process” in the task bar at the top of the page. In the pop-up menu, under “Payroll,” select “Payroll Cycle.” You will be directed to the Payroll Cycle page. If your company exports time and attendance data to a payroll system, it is important to run a payroll export just before closing a pay period. Add additional checks for bonuses, commissions, retroactive pay or advance pay. Select the employee for whom you want to create the additional check.

All of your employees will be imported into Time Tracker when you run your first sync. Then, you can create employees in either system moving forward. Timesheets captured in Time Tracker can be exported to ADP in just a few clicks. When you create time entries in Time Tracker, you can sync them back to ADP in a single click. Time Tracker makes it easy for employees in different locations to accurately keep track of time, no matter where they are. Admins are then able to easily view and approve all employee hours in one screen, or generate insightful productivity reports with the click of a mouse. Time entries can then be synced back to RUN Powered by ADP for faster, more efficient payroll.

Before Your Last Payroll Of The Calendar Year

You no longer have to key times into payroll every pay period. The ClockShark-ADP Connector saves you from hours of hassle and costs only $5 per month.

However, sometimes you need to make one-time changes. Input the appropriate salary information in the paydata grid. This will override the Automatic Pay for the employee for this pay period.

Adp Time Tracking

Now you can enter paydata for the additional check.Enter the tax frequency information, which calculates taxes based on the type of pay. For example, bonuses are taxed at different rates than regular pay. Hours.” Enter the number of regular hours each employee worked. The system will automatically calculate the gross salary, deductions and net salary for the pay period. Click on the “save” button frequently to save data you have entered. When you are done, click on the “done” button.Enter the number of overtime hours in the “O/T Earnings” column.

Run the extract process for each object group to extract data belonging to the grouped payrolls. Use the same approach to group employees that weren’t included in the extract or that must be extracted again. Uncover workforce insights hidden in your data with ADP Workforce Now®. The ADP WFN Timesheet Export will allow you send approved timesheets from Deputy into your ADP account. This will allow you to process payroll inside of ADP using the Deputy timesheet data.

Although you can perform an export at any time, exports can only be performed for current pay periods and are usually done as part of end of period/payroll preparation operations. If you export data before the end of a current pay period, the export will not be a complete record of all of the transactions in the pay period. This is ADP’s time management and attendance software. You can purchase it with your ADP software package.

- To use ADP for payroll, start by making a new payroll cycle to clear out any old data.

- Your company may employ salaried employees or hourly employees who work a fixed number of hours each pay period.

- Then click “Enter Paydata” and select “Paydata” from the popup menu.

- Once the popup window closes and the new payroll cycle page returns, you can set up the employees who are to be paid by clicking on “Process” in the task bar.

- Work with an ADP representative to set up Automatic Pay for these employees.

Once you have started a new payroll cycle, or if you would like to import your data into an existing payroll cycle, selectProcessfrom the top navigation bar. If your business has more than one company that processes payroll, confirm the correct company code. To change the company code, click on the magnifying glass icon and select the correct company code.If you don’t have more than one company, do nothing. This step clears out all of the data from the previous pay period. Then, it advances the system to the new pay period.Go to the payroll cycle page. task to group the payroll in a single extract.

Templates define what data is exported and how it is formatted. Your ADP Time & Attendance Representative has set up export templates for each pay cycle used by your company. As a practitioner, you can also create new export templates, as necessary. Employees sync both ways between Time Tracker and RUN Powered by ADP.

You can get into the system and manually correct or adjust any data as needed. This process saves a lot of time and limits mistakes due to data entry errors. The system keeps salary and tax data for each employee and automatically calculates this information based on the number of hours you input. Also, employees set up for Automatic Pay automatically receive a paycheck.

Track Time With Timers

Work with an ADP representative to set up Automatic Pay for these employees. This way, you won’t have to enter their pay data each pay period.You can make changes to an employee’s salary or number of hours any time you need to.