Your Biggest Payroll Tax Deferral Questions Answered

Content

One point that wasn’t covered in the guidance but that is extremely relevant, it’s clear that it’s voluntary for employers. They don’t have to do it, but the question is do you have to make it voluntary for employees? You would have to give every single employee an explanation of what you’re proposing, how it would work, when you’re going to withhold the money, what happens if they leave early, and give those employees an opportunity to respond.

Give them some time and provide for some mechanisms so that they can respond, and preferably electronically. Also, design your systems so that people can change their minds. That question applies to a hundred million people, and you got to ask that over the next few days. Because of prompt payment laws, the Research Foundation will permit appointments to the Research Foundation payroll to be processed for an employee waiting for a Social Security Number. Operating locations may assign a temporary TIN to the employee’s record until a valid number is received. Operating locations must inform persons with temporary tax identification numbers that they must apply for a SSN from the Social Security Administration within seven days of their employment start date.

Temporary Full Federal Funding Of The First Week Of Compensable Regular Unemployment For States With No Waiting Week (section :

But, it’s not important that you have the social security number of job applicants. Yet, many businesses ask for it in the application stage. While SSNVS is available to all employers and third-party submitters, you must register to use this service. You can only use this service to verify current or former employees and only for wage reporting (Form W-2) purposes. As a former employee, you’d want to involve your state’s Department of Labor. If giving your social security number is a required field on an online application, leaving the answer blank may not be an option.

It wasn’t a help line unless I could get through the automated system that was asking me for my SSN, Wich the one they have on record dosent actually exist. For the recors i worked overnight shift so could not talk to HR in person. After 6 weeks of working without pay or HR assistance to get the pay I quit.

Business Services Online (bso)

The Research Foundation is required to report valid SSNs on year-end tax statements. While fake online job postings are common and used to get you to fill out forms with personal information that can be used to steal your identity, this fraud is bold. Someone posing as a well-known employer actually calls you up and interviews you — and by the time it’s over you’ve got a phony job offer and the scammers have your very real social security number and other private information.

She STILL claims it should be able to activate and the SSN is STILL wrong. My money is being held hostage and there is no way to solve this through Aline as an employee with a card. Some employers require applicants to list their social security number when completing job applications. Not as controversial as required social security numbers, but still controversial, both salary history and salary requirements requests from employers also disturb job searchers. Job searchers regard the request for salary history as an infringement of their privacy.

Is it safe to give SSN on online application?

Asking for the social security number on an application is legal in most states, but it is an extremely bad practice. (Some states prohibit private employers from collecting this information for fear of identity theft.) It is not recommended that you provide this information on a job application.

On an I-9 form, employees must fill out their name, address, and SSN. Therefore, if such amounts were exhausted for an employee in 2020, any leave payments to that employee in 2021 don’t qualify for the tax credit in 2021. The employer may also request an employee to provide additional material needed for the employer to support a request for tax credits pursuant to the FFCRA. Rather than mandating COVID-19 vaccination, many employers plan to encourage employees to get it. Before implementing any such program, consult legal counsel. Additionally, some states require advance notice of any reduction in pay. Absent a specific notice requirement, employers should provide as much notice as possible.

In cases where employers conduct credit checks on employees as part of background checks, applicants will need to furnish their SSN in order to receive consideration. Background checks are typically conducted on candidates who have already passed through the initial screening of applications. However, several states have prohibited or limited the use of credit checks for job applicants. Just because you are asked for your social security number, does not mean you are obligated to give it out. It is important for job seekers to know that they are not legally required to provide their social security numbers to employers, with the exception of government and national security-related jobs or jobs that require a credit check. To access your W-2, you must have information from your last paystub of the year.

How Employers Help Scammers Steal Your Ss#

Documentation to show how the employer determined the amount of qualified leave wages paid to employees that are eligible for the credit, including records of work, telework and qualified leave. Because the credit is fully refundable, employers will receive reimbursement of the amount paid, subject to the caps, even if their tax liability is less than the amount paid out in the required leave. Emergency paid sick leave and PHEL wages paid are also exempt from Social Security taxes otherwise imposed on the employer. The requirement to provide this leave ended on December 31, 2020. However, employers that provide FFCRA qualifying leave voluntarily may be eligible for tax credits through March 31, 2021. Among the states and local jurisdictions that require employers to provide paid sick leave, many cover absences related to school closures that are ordered by health officials. Some jurisdictions are enacting emergency rules that would require such leave, so monitor the situation closely.

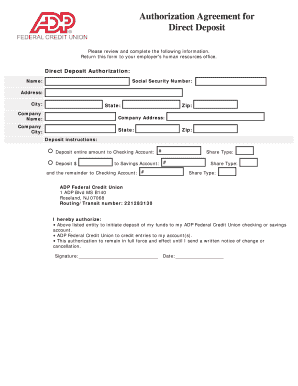

Below is an example of a pay stub from ADP, your employer’s payroll processor. Your paystub may look a little different, but should include the file number, company code and total federal tax withholding amount, similar to the paystub example.

Form W-4, Employee’s Withholding Certificate, is a new hire form your employees must complete. Use Form W-4 to determine how much to withhold in federal income taxes from employee wages. Employees must fill out personal information on Form W-4, such as their name, address, marital status, and SSN.

Several states including New York, Connecticut, and Massachusetts require employers to put safeguards like encryption in place to protect the privacy of job seekers. However, several states have prohibited or limited the use ofcredit checksfor job applicants. Most employers that do conduct these checks do not do so until you are further along in the hiring process than the initial application. When the employer invites the job searcher for an interview and especially if they plan to make a job offer to the candidate, job applicants need to understand that the employer will need the SSN to make background checks. ADP is committed to assisting businesses with increased compliance requirements resulting from rapidly evolving legislation. Our goal is to help minimize your administrative burden across the entire spectrum of employment-related payroll, tax, HR and benefits, so that you can focus on running your business. This information is provided as a courtesy to assist in your understanding of the impact of certain regulatory requirements and should not be construed as tax or legal advice.

That payroll tax holiday, that you probably aren’t getting, technically went into effect Tuesday. A lot of employers aren’t participating — at least not yet — in this Trump administration economic relief approach. Recruiters don’t need the full social security number until the contract write-up for whichever government document you fill in like W-4. Some recruiters do need the last 4 digits of your SSN because it might be required by their client so the client company can do a background check on you.

Such information is by nature subject to revision and may not be the most current information available. ADP encourages readers to consult with appropriate legal and/or tax advisors. Please be advised that calls to and from ADP may be monitored or recorded. For the latest on how federal and state tax law changes may impact your business, visit the ADP Eye on Washington Web page located at /regulatorynews. After your employee begins working, be sure to add them to payroll and withhold payroll taxes from their wages. Depending on your state and business, you might also need to gather additional new hire documents, such as a state W-4 form, from employees. Form I-9, Employment Eligibility Verification, is a form used to confirm your employee is legally allowed to work in the U.S.

Nevertheless, federal law currently does allow employers to require fitness-for-duty certifications for employees to return to work, provided they are announced in advance and applied consistently. As a practical matter, though, doctors and other healthcare professionals may be too busy to provide fitness-for-duty documentation. Therefore, new approaches may be necessary, such as reliance on local clinics to provide a form, a stamp, or an e-mail to certify that an individual can return to work.

Employers are one of the few organizations that really need social security numbers, as you have to pay employees, withhold taxes, and pay taxes. This is the most frustrating thing I have ever been through. So when applying for my Aline ADP card at my employers, I typo’d my social security number. To show how useless my HR rep is, it took numerous phone calls for her to realize the social was wrong and I needed to give her a fax of my actual SSN card.

Your Biggest Payroll Tax Deferral Questions Answered

However, if they do report to work, you must pay these employees for any time they actually worked and/or were required to stay at work while your company made a decision to close. Note that some state laws require employers to pay employees for a minimum number of hours when they report to work but are sent home before the end of their scheduled shift. Check your applicable law for rules related to paying employees when they are required to report to work but are sent home early.

Before filling in your social security number, make sure you are on the company’s legitimate site. If you are applying for the job through a job search site, consider researching or calling the company before applying to confirm that the posting is legitimate. Employers are permitted to ask applicants for their social security numbers in all states.

- The Form 941 will provide instructions about how to reflect the reduced liabilities for the quarter related to the deposit schedule.

- The time off may also be protected under federal, state, and local laws entitling employees to job-protected leave.

- For instance, an employee taking time off to take care of a family member with a serious health condition may be protected under the federal Family and Medical Leave Act, similar state laws, and/or state and local paid sick leave laws.

- This is intended to provide the funds needed to pay sick and family leave benefits under the law.

- Keep in mind as well that, generally, some states prohibit employers from taking adverse action against an employee for engaging in lawful off-duty conduct, such as travelling to another country or state where travel is allowed.

The Form 941 will provide instructions about how to reflect the reduced liabilities for the quarter related to the deposit schedule. Keep in mind as well that, generally, some states prohibit employers from taking adverse action against an employee for engaging in lawful off-duty conduct, such as travelling to another country or state where travel is allowed. The time off may also be protected under federal, state, and local laws entitling employees to job-protected leave. For instance, an employee taking time off to take care of a family member with a serious health condition may be protected under the federal Family and Medical Leave Act, similar state laws, and/or state and local paid sick leave laws. The tax credit effectively reduces the amount of federal employment taxes that must be deposited with the IRS, usually within a few days of the payroll date.

You will also need your Social Security Number from the paystub or your personal records. In the guidance published on December 16, 2020, the EEOC states that simply requesting proof of receipt of a COVID-19 vaccination isn’t likely to elicit information about a disability and, therefore, isn’t a disability-related inquiry. The Internal Revenue Service Code requires any person working in the U.S. to provide a valid Social Security Number to his or her employer. This is the employee’s Taxpayer Identification Number required by the federal government for reporting purposes. If the employee does not have a Social Security Card, he or she must file an Application for a Social Security Card (Form SS-5) with the Social Security Administration within seven days of beginning employment. Temporary Taxpayer Identification Numbers may be assigned by operating locations to new employees who do not have a valid SSN.

This happens often when you are looking at a job with a bank or other financial institution. My soon-to-be boss called HR to let them know that they were hiring me, that I was here and I would be coming over to their office to fill out the paperwork so I could start working. No pushback from HR, no complaints about the library or me not following procedures. But, say all the recruiters, we need the social security number to run background checks. If the job requires a credit check , then you need a social security number to run the check. And you should not be running any of this at the application stage.

This is intended to provide the funds needed to pay sick and family leave benefits under the law. However, in some cases, such as complete closure of a business, the Treasury Department and IRS will process claims for advance payments of the tax credit. Beyond the tax implications, if the paid leave in question is required under state and/or local law, employers should ensure that the law allows employees to donate their leave to fellow employees.