How To Find & Calculate Adp 401 2021

Content

The platform covers recruiting, hiring and onboarding, payroll and tax compliance, HR and benefits administration, HR reporting and analytics, and learning management. Our platform modernizes the way you manage people, from the way you recruit, onboard and develop talent to the way you pay and retain them, and build a company culture. Whatever your people management goals are, we’ll help you accomplish them with the right technology and the best support and thought leadership. You need technology plus expertise, at every level and at every stage, to keep your human resources software modern and adaptable.

Some competitor software products to CenterPoint Payroll include StarGarden HCM, SentricHR, and Dominion Systems. AccountantsWorld is a software company based in the United States that was founded in 2001 and offers a software product called Payroll Relief. Payroll Relief offers training via documentation, webinars, and live online. Payroll Relief offers online support, and business hours support. Payroll Relief is available as SaaS, Android, iPhone, and iPad software. Some alternative products to Payroll Relief include EPAY HCM, SyncHR, and Gusto. Integrate business functions and procedures into a single source and increase efficiencies with Insperity® Workforce Acceleration™, a comprehensive payroll and human capital management solution.

Adp Teampay

Gusto’s online payroll service is popular enough to sync with most accounting software options. MHR is a software company based in the United Kingdom that was founded in 1984 and offers a software product called iTrent. iTrent offers training via documentation, webinars, live online, and in person sessions. iTrent offers online support, business hours support, and 24/7 live support. Some alternative products to iTrent include Workday HCM, UKG Pro, and Workzoom. QuickBooks Online is available in three service plans – Core, Premium and Elite – which all allow small business owners to run payroll and file taxes automatically.

Online payroll software can provide a wide range of payroll reports to businesses. These reports can give you better insight into your company and employees. The types of payroll reports that some services offer include payroll registers, contribution reports and payroll tax reports. QuickBooks Online Payroll by Intuit provides businesses of all sizes with payroll and related tax services.

When Adps Pricing Is Right

Your time tracking data automatically flows into your account. You can approve timesheets, pay your team, and create invoices right from your phone. Free up valuable time and set your payroll to run automatically. If you turn on Auto Payroll, we’ll also send notifications to help you manage your account. Zenefits is a SaaS cloud-based human resources platform that helps more than 11,000 small and mid-sized companies empower their workforce, manage change and stay compliant. Zenefits’ People Platform delivers the most comprehensive, intuitive HR experience in the market.

- MHR is a software company based in the United Kingdom that was founded in 1984 and offers a software product called iTrent.

- Gusto’s online payroll service is popular enough to sync with most accounting software options.

- Starting at $19 a month, Gusto calculates and files your payroll taxes, helps with workers comp administration, and lets you build paid time off policies for your employees.

- If you’re comparing pricing to features, Gusto offers the best small-business payroll software.

Simplify managing payroll and HR to spend more time on business priorities and less time on processes. Automate your people and payment processes to save time and reduce manual, paper-based administration. With self-service access to payroll, HR and benefits data, empower your people to take control of their own information. Get help managing compliance, and delivering payroll and tax filings in an accurate and timely manner. Paycor is an all-in-one HR software solution built to help organizations efficiently manage their people. Trusted by more than 30,000 medium-sized and small businesses, Paycor modernizes practically every aspect of people management.

Find The Right Payroll Services For Your Business

The company’s payroll offerings include Sage Essentials, for businesses with fewer than 10 employees, and Sage Payroll Full Service. Sage Payroll Essentials provides unlimited processing, tax filing and direct deposit for a flat monthly fee, while Sage Payroll Full Service outsources your work to Sage’s payroll professionals. Square offers a PC and mobile-friendly app that assists businesses with payroll management. The platform can be used for employees, contractors, or both at the same time, and monthly pricing adapts to the number of people on the payroll. Other additional features include tracking of work hours, automated filing of state and federal taxes, monitoring sick leave, and workers’ compensation.

Is ADP a good company?

ADP has traditionally been known as a great company to work for. Many employees have been there for 20+ years. However, that changed starting around 2015 as the company embarked on a strategy to remake itself into a “tech” SAAS company as new cloud-based companies entered HCM.

As a cloud-hosted service, it doesn’t require you to install or maintain any software. You can log in to the system to process payroll, review and pay payroll taxes, and view detailed labor reports, while your employees can view their paystubs, pay history and PTO accruals. OnPay doesn’t sacrifice features and value by edging toward simplicity. Users can enjoy payroll processing, tax compliance, multiple employee types, multiple payment options and employee self-service access. This software can also integrate with many popular small business services, like QuickBooks Online, Xero, Kabbage, Humanity, Guideline and ThinkHR. Gusto is our choice for the best online payroll software with added HR tools because of the many HR services it offers.

If you’re comparing pricing to features, Gusto offers the best small-business payroll software. Starting at $19 a month, Gusto calculates and files your payroll taxes, helps with workers comp administration, and lets you build paid time off policies for your employees.

Quickbooks Payroll

A seriously powerful workforce management tool to help your business run better. Get peace of mind with efficient, accurate payroll software. Input, store and access employee data and performance reviews in one easy place. Get your new employees on their way quickly with this paperless process. Easily pay your team and access powerful tools, employee benefits, and supportive experts with the #1 online payroll service provider.

Paychex Flex offers cloud-based payroll and human resources software to small businesses that really need the help but don’t want to deal with full-on HR outsourcing. Each Paychex plan includes new-hire state reporting, automatic payroll tax filing, and even an employee financial wellness program. And while most of the software options we’ve listed include a report or two, Paychex Flex blows everyone else out of the water by offering a whopping 160+ reports with its payroll and HR packages. This processing fee also includes training, service, and support as well as upgrades. The online payroll system opens into a well-designed browser interface that immediately displays the firm’s client list, with options to search or sort by various methods.

Extra Charges For Tax Assistance

It also grants access to certified HR professionals who can guide you through all sorts of situations. Founded in 1979, Red Wing Software is a software organization based in the United States that offers a piece of software called CenterPoint Payroll. CenterPoint Payroll features training via documentation, live online, webinars, and in person sessions. The CenterPoint Payroll software suite is SaaS, and Windows software. CenterPoint Payroll offers business hours, and online support.

Other services in the various plans include a workforce portal for employees, health benefits from SimplyInsured, time tracking, an HR support center and project management. Unlike ADP, Gusto prepares year-end tax reports (W-2 and 1099s), integrates with other software, and gives you onboarding and compliance support at no additional cost. Sage is a provider of business management software and services to small and midsize businesses.

Is payroll considered an expense?

Payroll expense is the amount of salaries and wages paid to employees in exchange for services rendered by them to a business. The term may also be assumed to include the cost of all related payroll taxes, such as the employer’s matching payments for Medicare and social security.

Your employees will love the tools that help them stay connected, share ideas, seek help, and collaborate. Human capital management in the cloud to engage employees, reduce complexity and work smarter. Identify, attract, hire, reward, and develop the best and brightest people – fast. Access and audit payroll that is continuously calculated and up-to-date. Help every employee make fast, informed decisions with data-driven insights.

When new employees are hired, HR professionals using Zenefits only need to complete a few online fields to begin the onboarding process. Employees sign all agreements online, and Zenefits can automatically process their information. When employees leave, HR can remove them from payroll and benefits and initiate COBRA setup with a single process. ADP’s midsize solution is Workforce Now, which is designed for businesses with 50 to 999 employees. Like their other plans, this is also a cloud-based HR management option that can help you with payroll, HR management, benefits, talent, and more. Here’s a rundown of the plans within Workforce Now and the features you’ll receive.

The client selection list provides a useful spreadsheet overview of key information, including contact information and the next payroll run date. Additionally, the menu on the left changes to provide tasks specific to the tab selected. iSolved enables you to collect, manage and process time to more effectively manage your employee time and attendance data. Move beyond outdated time sheets and spreadsheets to process employee time and attendance with proficiency. iSolved Time also includes the option to calculate comp time in lieu of overtime pay. Payroll + HR + Benefits + Time data, all in one platform that also delivers a better work life for your employees. You’ll love having your important, commonly needed, mission-critical employee data available in one place.

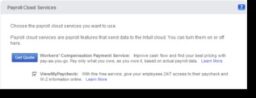

Manage payroll and access HR and employee services in one place. Pay your team automatically once your payroll setup is complete. We’ll calculate, file, and pay your payroll taxes automatically. Manage benefits and employee services from your payroll account. You’ll also have the flexibility to pay your team when you want with same-day direct deposit.